Friday, September 29, 2006

Thursday, September 28, 2006

S&O's for the 9/28/06 close.

YI: +4.5 (Some type of topping process may be on the way for the market.)

Possible bottom in this area for: YHOO

Now standard oversold: RHAT

Trying to hold on to some rising trend line support: BBBY, BPOP, C, MDT, Q, TTH, and VZ

Attempting to hold the 28 DMA here: TSS

To a hold for now: GG

Trying to break above some falling trend line resistance now: AA, AAUK, GLG, PEG, STP, and XLP

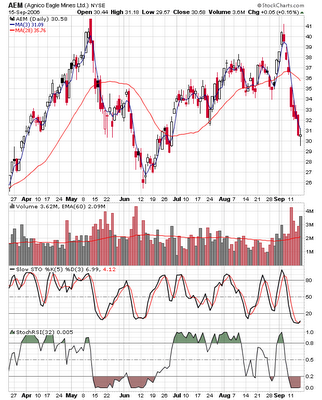

Attempting to break above the 28 DMA here: ABX, AEM, ASA, GLD, gold, KGC, RGLD, RIO, SFY, SLV, SU, XLE, the XNG index, and the XOI index.

Now up against some rising trend line resistance: ARM, DELL, ENR, SCHW, THQI, and XLK

Moderately overbought at this point are: CAKE, the E-Mini 500, GM, SLE, and YCC

Extremely overought now: MCD

A possible top may be forming in this area for: NST

To a sell: The XAU hourly at 1 PM.

A break out in either direction is on the way for: ELN

And as is always the case, anything posted here may be off base.

S&O's based on the closing prices of 9/27/06

The YI at +4 again means the market is now in a fairly overbought condition.

Moderately oversold now is: PMCS

Trying to hold some rising trend line support at this point: KMX and SPC

Attempting to hold the 28 DMA here: AMD

To no position for now: INTC

To a hold: HMY

Trying to break above some falling trend line resistance here: ARM, BA, CGI, COP, ECA, HMY, IFN, RIG, SFY, STMP, STX, SU, and WDC

Attempting to break above the 28 DMA here: BHI, FCX, OXY, TXU, and WMB

Now up against some rising trend line resistance: AMZN, BMS, CREE, the DJ-30, and JCP

Moderately overbought at this point: GR, INTC, and MDC

Standard overbought here: BAC, BBBY, the BKX index, GLW, JNPR, NWL, the S&P-500, and 2T104

Extremely overbought now: The OEX index.

A possible top may be forming in this area for: MER and YCC

And as is always the case of course, anything posted here may be off base.

S&O's based on the closing prices of 9/27/06

The YI at +4 again means the market is now in a fairly overbought condition.

Moderately oversold now is: PMCS

Trying to hold some rising trend line support at this point: KMX and SPC

Attempting to hold the 28 DMA here: AMD

To no position for now: INTC

To a hold: HMY

Trying to break above some falling trend line resistance here: ARM, BA, CGI, COP, ECA, HMY, IFN, RIG, SFY, STMP, STX, SU, and WDC

Attempting to break above the 28 DMA here: BHI, FCX, OXY, TXU, and WMB

Now up against some rising trend line resistance: AMZN, BMS, CREE, the DJ-30, and JCP

Moderately overbought at this point: GR, INTC, and MDC

Standard overbought here: BAC, BBBY, the BKX index, GLW, JNPR, NWL, the S&P-500, and 2T104

Extremely overbought now: The OEX index.

A possible top may be forming in this area for: MER and YCC

And as is always the case of course, anything posted here may be off base.

Wednesday, September 27, 2006

Tuesday, September 26, 2006

S&O's for the close of 9/26/06

YI: +4

To a buy: CDE and the XAU hourly at 10 AM.

A possible bottom may be forming in this area for: CHK and COP

Trying to bottom out as best as they can: MSCC and NTES

Standard oversold at this point: GRZ

Moderately oversold now: REDF

Trying to hold some rising trend line support here: FXE and GNSS

Attempting to hold the 28 DMA in this area: CLG and FDP

Trying to break above some falling trend line resistance here: ACF the BTK index, CAT, ERF, EWA, IDA, IIT, JNJ, PTR, and WHR

Attempting to break above the 28 DMA in this area: NOK

Now up against some rising trend line resistance: AIG, C, the IIX index, LMT, and MCD

Moderately overbought now: BKS and RHAT

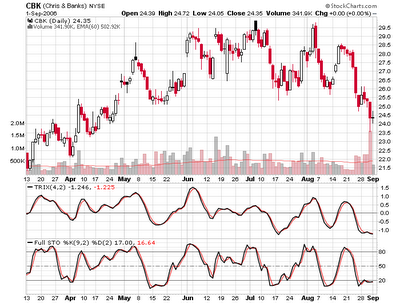

Standard overbought at this level: CBK

Anything posted above could be off base.

S&O's for the close of 9/25/06

YI: +3.5

A possible bottom may be forming in this area for: AU and RIO

Trying to bottom as best they can at this point are: NSC, SNE, STP, and the XNG index.

Standard oversold now: MSCC, NTES, and X

Moderately oversold: PCU, SFY, TZOO, and WOR

Trying to hold some rising trend line support in this area: The dollar, ENER, ENR, IYM, LSS, PDE, SMTC, SYMC, WTS, and XLP

Trying to hold some falling trend line support: AA, CAT, and PTR

Attempting to hold the 28 DMA here: CSTR, IRF, LSI, MRVL, MU, RADN, TMO, WHR, and WON

To no position for now: ENR

Trying to break above some falling trend line resistance in this area: CAKE, JNJ, KO, OGE, TASR, and YCC

Now up against some rising trend line resistance: AAPL, ACAS, MRK, and SEE

Moderately overbought at this point: BA

Extremely overbought: TTH

And of course as is always the case, anything posted above may be off base.

Sunday, September 24, 2006

S&O's based on the closing prices of 9/22/06

YI: +2.5

To a buy: GG and HMY

A possible top may be forming in this area for: AEM and BAA

Trying to bottom out in this area: AU, CUP, HIT, MTU, NFI, OGE, PEG, and TASR

Standard oversold now: RDC, XLE, and YHOO

Moderately oversold at this point: NSC and PDE

Trying to hold some rising trend line support here: AMAT, the BKX index, CMI, CPB, DELL, the DJ-30, ELN, FDP, IDA, IWM, MDT, MFE, TKR, TSS, TXU, WGII, and the XCI index.

Trying to hold falling trend line support: ARM, CAT, ECA, and GRZ

Attempting to hold the 28 DMA here: ACF, ALEX, AMZN, GE, INTC, MDC, NVLS, PMCS, QLGC, RMBS, SMH, SNA, SNDK, TSY, and XLP

Trying to break above some falling trend line resistance here: BA, GR, LMT, and RHAT

Now up against some rising trend line resistance: BAC and CLG

Moderately overbought now: TYC

Standard overbought at this point: EWP, PG, PHG, SYMC, and VZ

Extremely overbought and may be getting ready for some type of correction: GYMB

A possible top may be forming in this area for: MAT

A break out in either direction is on the way for: RIG

And as is always the case of course, anything posted here could be way off base.

Friday, September 22, 2006

S&O's based on the closing prices of 9/21/06

YI: +3

A possible bottom may be forming in this area for: ERF and NEM

Trying to bottom out at this point are: ASA, ECA, FCX, GLG, SLV, and SU

Standard oversold: STP and SUN

Moderately oversold now: EBAY

Trying to hold some rising trend line support here: ABX, AMAT, BMY, CREE, CSCO, GE, IRF, NSC, OGE, SBUX, SMH, and TXU

Trying to hold some falling trend line support: RIO and SFY

To no position for now: EWP and PHG

Trying to break above some falling trend line resistance here: GG, CAKE, CBK, MDT, RHAT, and SWC

Trying to break above horizontal trend line resistance: BAC

Now up against some rising trend line resistance here: RNR and TTH

Moderately overbought now: C and ELY

Standard overbought at this point: EWD, JNPR, and JOSB

A possible top may be forming in this area for: MTU, PNRA, and SYMC

To a sell: JWN

And of course as is always the case, anything posted here may be way off base.

Wednesday, September 20, 2006

S&O's based on the closing prices of 9/19/06

YI: +3

Moderately oversold at this point: CUP, EWJ, F, NOK, and XLU

Trying to hold some rising trend line support on the daily chart: AMZN, BGF, CAKE, CBK, CSCO, MU, NSM, QCOM, REDF, RNR, SHI, SNA, SNDK, TSY, and TZOO

Attempting to hold the 28 DMA here: ADP, AMN, BMS, GM, KEA, MRK, and NST

Trying to break above some falling trend line resistance now: BAA, CLF, JNPR, NLY, and USU

Attempting to break above the 28 DMA here is: STMP

Now up against some rising trend line resistance: C

Moderately overbought at this point: MRVL, PNRA, SMTC, and SPC

A possible top may be forming in this area for: EWD and PHI

To a sell: ENR and the XAU hourly chart at 10 AM yesterday.

And as is always the case of course, anything posted here could be way off base.

Tuesday, September 19, 2006

S&O's based on the closing prices of 9/18/06

YI: +3.5

To a buy: HMY

A possible bottom may be forming in this area for: CUP, FTO, and GG

Trying to bottom out at this point are: COP, MTU, and SUN

Standard oversold now: HIT and PEG

Moderately oversold: GR and NG

Trying to hold some rising trend line support here: AMN, ERF, GNSS, and RI

Trying to hold some falling trend line support: VXO

Trying to break above some falling trend line resistance: CDE, CLF, EOG, MDC, OCR, and PNRA

Attempting to break above the 28 DMA here: AA

Now up against some rising trend line resistance: CREE

Moderately overbought at this point: AMZN, GLW, IIT, LYO, SMTC, STX, and YCC

Standard overbought now: GOOG, PHI, and PLL

A possible top may be forming in this area for: ACAS, BBBY, CHC, GE, MER, MFE, MOT, QQQQ, SCHW, TMO, and WHR

To a sell: MCRS

And of course as is always the case, anything posted here may be way off base.

Monday, September 18, 2006

S&O's based on the closing prices of 9/15/06

YI: +3

Trying to bottom out now: ABX, AEM, heating oil, FTO, and GFI

Standard oversold at this point: BHI

Moderately oversold now: DJ, DO, GLD, KGC, and RDC

Trying to hold some rising trend line support: GLG, KMX, and PLT

Attempting to hold the 28 DMA here: EMC

Trying to break above some falling trend line resistance: ACF, the BKX index, and WOR

Attempting to break above the 28 DMA here: EWU and FBR

Now up against some rising trend line resistance: The OEX index and RFMD

Moderately overbought now: ALEX, BBBY, CY, ERIC, EWD, IFN, IWM, JNPR, LSI, SGP, SLE, TSM, and XMSR

Standard overbought at this point: AIG, CSTR, DVY, ENER, GYMB, MER, QQQQ, and THQI

A possible top may be forming in this area for: AMD, AMTD, BPOP, CSCO, the DJ-30, the IIX index, INTU, PBY, SNA, the S&P-500, SYMC, TTH, the XCI index, XLF, and XLK

Anything posted here may be off base.

Friday, September 15, 2006

S&O's based on the closing prices of 9/14/06

YI: +2.5

Trying to bottom out at this level: The XAU hourly.

Moderately oversold now: EWC and PEG

Trying to hold some rising trend line support: F

Attempting to break above the 28 DMA here: PG

Trying to break above some falling trend line resistance at this point: CGI, FTO, GOOG, N, PEG, SNE, STX, SU, and YCC

Attempting to break above the 28 DMA here: BA, NFI, and WTS

Now up against some rising trend line resistance: AAPL, AMD, the DJ-30, ERIC, and SEE

Moderately overbought now: ACF, the BKX index, CBK, CHC, CY, ENER, GE, GM, GPC, IRF, JOSB, MFE, MMC, PNRA, QQQQ, SLE, TKR, and TSS

Standard overbought at this level: DVY, JWN, and SYMC

Extremely overbought now: KMX

A possible top may be forming in this area for: BMY, the E-Mini 500, and THQI

And as is always the case of course, anything posted here may be off base.

Thursday, September 14, 2006

S&O's based on the closing prices of 9/13/06

YI: +2.5

A possible bottom may be forming in this area for: SU, USU, and the XOI index.

Trying to bottom out in this area: ASA, CDE, ECA, EOG, ERF, gold, NEM, OXY, SUN, SWC, and the XAU index.

Standard oversold at this point: AU, COP, GG, and heating oil.

Moderately oversold now: AEM, GFI, and TXU

Trying to hold some rising trend line support here: CUP, GLD, GRZ, KGC, and PEG

Attempting to hold the 28 DMA: LMT

Trying to break above some falling trend line resistance: AMZN, BA, BBBY, BKS, CHK, FTO, OCR, PNRA, PTR, SVU, XLE, and YHOO

Attempting to break above the 28 DMA here: STX

Now up against some rising trend line resistance: CSCO, the E-Mini 500, NSM, NVLS, PHG, SCHW, the S&P-500, TTH, VZ, and YCC

Standard overbought at this point: APPB, BKC, GM, IBM, RI, WHR, and the XCI index.

A possible top may be forming in this area for: F and MOT

Anything posted here may be off base.

Wednesday, September 13, 2006

S&O's based on the closing prices of 9/12/06

YI: +2

Trying to bottom out in this area are: AAUK, AU, BAA, BHI, CMI, HMY, NEM, NX, and PTR

Standard oversold at this point: EOG, GG, SU, and the XOI index.

Moderately oversold now: ASA, CAT, CHK, CUP, ERF, FCX, gold, HMC, MG135, MTU, PD, RGLD, SFY, SLV, WMB, the XAU index, and the XNG index.

Trying to hold some rising trend line support here: ABX, CIG, DO, WY, and X

Trying to hold some falling trend line support: AA, RIO, and TIE

Attempting to hold on to the 28 DMA: AMN, GLG, and KGC

Trying to break above some falling trend line resistance now: AMZN, BA, FBR, GLW, PHI, and STMP

Attempting to break above the 28 DMA is: NTES

Moderately overbought at this point: BMY, NWL, and SVU

Standard overbought: MU

A possible top may be forming in this area for: AIG

And as is always the case of course, anything posted here may be off base.

Tuesday, September 12, 2006

S&O's based on the closing prices of 9/11/06

YI: +1

To a buy: FBR

Trying to bottom out now: BA and STX

Standard oversold at this point: BAA and OXY

Moderately oversold now: CDE, DELL, ELY, EWA, OCR, and OGE

Trying to hold some rising trend line support: CLF, EWC, HIT, IIT, SEE, and TYC

Trying to hold some falling trend line support: EWJ, HMY, and SWC

Attempting to hold the 28 DMA here: AMN, AMZN, EWG, JNPR, KO, PMCS, Q, SGP, SIFY, the S&P-500, TASR, and WGII

To a hold for now: ARM

Trying to break above some falling trend line resistance: FDP and TKR

Standard overbought at this point: KMX and RNR

A possible top may be forming in this area for: BGF

A break out in either direction is on the way for: IFR, MRVL, and SPC

And of course as is always the case, anything posted here may be off base.

Monday, September 11, 2006

S&O's based on the closing prices of 9-8-06

YI: +1

Trying to bottom out at this point: ARM, FBR, FTO, IFN, NOK, STMP, and WOR

Standard oversold: AU and NX

Moderately oversold now: AAUK, AMTD, BAA, CGI, CMI, ENER, FXE, HIT, HMY, NEM, SNE, STP, WB, WDC, and XMSR

Trying to hold some rising trend line support here: ACF, gold, KGC, PEG, RHAT, SCHW, SLV, the S&P-500, TZOO, and VZ

Trying to hold some falling trend line support: AMZN, NFI, and WTS

Attempting to HOLD the 28 DMA here: AEM, BKS, C, CHC, DVY, the S&P-500, EWA, EWI, EWJ, EWP, GLW, JNJ, N, NVLS, NXL, PHG, PLL, TSM, XLF, and YCC

Trying to break above some falling trend line resistance now is BAC

A break out in either direction is on the way for: AA, CREE, and NSC

And as is always the case of course, anything posted here may be off base to due market conditions and human error.

Thursday, September 7, 2006

S&O's based on the closing prices of 9/7/06

YI: +1

Trying to bottom out at this point: MDC

Moderately oversold now: ECA, EOG, FTO, NOK, NSC, PEG, and STX

Trying to hold on to some rising trend line support at this level: AA, ACF, AMN, ASA, BMS, KO, LYO, MDT, MU, NG, OXY, PNRA, POM, RADN, RFMD, RHAT, SNA, SNDK, SUN, TIE, VZ, and WON

Trying to hold some falling trend line support: BA and WTS

Attempting to hold on to the 28 DMA here: The BTK and DRG indices, ELN, ERIC, EWD, IDA, IWM, KEA, MSCC, REDF, SMH, THQI, TSM, TSS, and XLU

Moderately overbought now are: AVP, BKC, DO, PCU, PDE, PHI, RIG, SCHW, and SVU

And as is always the case of course, anything posted here may be more or less off base, depending on market conditions and human error.

Wednesday, September 6, 2006

S's & O's based on the closing prices of 9/5/06

YI: +2.5

Moderately oversold: GNSS and TZOO

Trying to hold some rising trend line support: ACAS, ERF, KEA, MOT, SMH, STP, and STX

Trying to hold some falling trend line support: NFI

Attempting to hold the 28 DMA here: SMTC and XMSR

To no position for now: CAKE

Trying to break above some falling trend line resistance: AIG, CHK, GYMB, IIT, SKS, THQI, TYC, and USU

Trying to break above horizontal trend line resistance: SEE

Attempting to break above the 28 DMA here: ARM, LSI, and SNE

Now up against some rising trend line resistance: The DJ-30, EBAY, and the OEX index.

Moderately overbought here: JWN, MFE, OGE, SIFY, SLV, and WDC

Standard overbought at this point: CLG, CSCO, and FCX

A possible top may be forming in this area for: DJ, INTC, RI, SNDK, and the XCI index.

Probable top here for: ENR

A break out in either direction is on the way for the dollar.

Anything posted above may be off base.

Monday, September 4, 2006

Bush warns on foreign oil dependence...

Geez, I have been "screaming" about this for twenty years!

Better late than never I guess, but what took so long for our president and most republicans to wake up on this very obvious and extremely serious problem?

Thousands dead and seriously wounded because of Iraq? What a damn shame it takes a tragedy like Iraq to finally wake some people up and take off their blinders.

S's & O's based on the closing prices of 9/1/06

YI: +2.5

Trying to bottom out here: CBK and JCP

Standard oversold at this point: BHI and JOSB

Moderately oversold now: EOG, FTO, GG, OXY, PTR, SUN, WTS, and the XOI index.

Trying to hold some rising trend line support in this area: AMAT, the BTK index, DELL, EWP, GE, MSCC, and STMP

Attempting to hold the 28 DMA here: BAC, NOK, and the XNG index.

Trying to break above some falling trend line resistance here: AAPL, AU, the BKX index, CREE, EWJ, DO, MFE, PDE, RGLD, SVU, and the XAU index.

Attempting to break above the 28 DMA here: AA, LSI, and ACF

Now up against some rising trend line resistance: NWL and the S&P-500.

Moderately overbought at this point: EWA, GYMB, JNPR, CAKE, PLL, QCOM, QQQQ, RNR, STX, and TSM

Standard overbought now: KMX, ABX, CLG, HPQ, MCRS, NVLS, and SNDK

Extremely overbought here: GLG and NST

A possible top may be forming in this area for: LYO, NG, and OGE

A break out in either direction is on the way for: MDC

And of course, anything posted here may be off base due to human error.

Friday, September 1, 2006

S's & O's based on the closing prices of 8/31/06

YI: +2

Trying to bottom out in this area: BAA, heating oil, GR, and RIG

Moderately oversold now: COP, KO, and SU

Trying to hold some rising trend line support here: EOG, GLW, JCP, PHG, SFY, and TKR

Attempting to hold the 28 DMA here: CREE, LMT, and WMB

To no position for now: AMZN and the XAU hourly.

Trying to break above some falling trend line resistance at this point: CAT, CMI, CPB, EMC, GFI, GRZ, MMC, OCR, PBY, and RMBS

Attempting to break above the 28 DMA here: BMY, PNRA, SBUX, SHI, SPC, and TSY

Now up against some rising trend line resistance: EWI, T2104, and WGII

Moderately overbought now: AMZN, DELL, DJ, the DJ-30, EBAY, ELY, ENER, ERIC, GT, the IIX index, IWM, MAT, MDT, NSM, PLT, QLGC, RADN, RI, SGP, WHR, XLB, XLE, and YCC

Standard overbought at this level: BGF, the DRG index, ENR, F, NVLS, TTH, and XLP

Extremely overbought now: AMN

A possible top may be forming in this area for: AMAT, AMN, APPB, C, GT, MU, SMH, VZ, and XLK

And of course, anything posted here may be off base due to human error.