Wednesday, May 31, 2006

Daily Update 5/31/06

YI: -1

Standard oversold at this point is: DJ

Trying to hold some rising trend line support here: CUP and EWI

Attempting to hold some falling trend line support: MSCC

Trying to break above some falling trend line resistance at this point is: ERICY, gold, JDSU, NXL, SMTC, and SUN

Attempting to break above the 28 DMA here: ACF, DELL, DUK, EWU, FTO, MG135, MU, NG, NOK, NSC, PEG, PHI, POM, RIO, SFY, SU, TTH, X, XLE, the XNG index, and the XOI index.

Now up against some rising trend line resistance is: MOT and NEM

Moderately overbought at this point: GLG

Standard overbought at this level: N, SNA, and TXU

To a sell: The XAU hourly at 11 AM yesterday.

Anything posted here may be off base.

Monday, May 29, 2006

Daily Update for: 5/30/06

YI: +0.5

To a buy here: MDC

Trying to bottom out in this area is: CAKE

Standard oversold at this point: OCR

Trying to hold some rising trend line support now: ADP and the VXO

Trying to hold some falling trend line support is: MRVL

To a hold at this juncture: FDP

Trying to break above some falling trend line resistance: BKC, CREE, F, JNPR, LYO, NVLS, RADN, SBUX, SCHW, SEE, TSY, WHR, and the XCI index.

Attempting to break above the 28 DMA here: ECA, ERF, EWC, FDP, KEA, OXY, RIG, and TRF

Now up against some rising trend line resistance: BGF

Moderately overbought now: AMZN, BHI, CUP, EBAY, XLP, and YHOO

A possible top may be forming in this area for: CPB and GM

Anything posted here may be off base.

Friday, May 26, 2006

Daily Update 5/26/06

The YI is now at the zero line once again.

To a buy: PMCS

A possible bottom may be forming in this area for: AU, FCX, IFN, JNPR, RDC, and RHAT

Now attempting to bottom out are: ACF, EMC, EOG, GG, INTC, PHI, SHI, SPC, TSM, and the XNG index.

Extremely oversold at this point: XMSR

Standard oversold now is: ELY

Moderately oversold: BKC, MCD, and NWL

Trying to hold some rising trend line support here: AMD, CLG, and NSM

Gold is attempting to hold the 50 day moving average.

Trying to break above some falling trend line resistance: EWJ, FBR, GE, HMC, Q, TZOO, and VIGN

KO is now up against some rising trend line resistance.

ADP and JNJ are moderately overbought at this juncture.

Anything posted here may be off base.

Thursday, May 25, 2006

Daily Update 5/25/06

YI: -1

A possible bottom may be forming in this area for: AMAT

Trying to bottom out: APPB, EWJ, FBR, MFLX, NXL, the 4Q, RFMD, TSS, and the YI

Standard oversold now are: CREE, the E-Mini 500, JWN, NSM, NVLS, the OEX index, PNRA, QCOM, RADN, SMH, STP, and VIGN

Moderately oversold at this point: AAPL, DVY, PETM, PMCS, and YCC

Trying to hold some rising trend line support here: EWP, GE, HIT, JOSB, PHI, PLL, SCHW, SKS, SNDK, SYMC, and XLU

Attempting to hold horizontal trend line support: BBBY

Trying to hold some falling trend line support: STX and WON

To no position: The XAU hourly at 3 PM yesterday.

To a hold for now: RGLD

Attempting to break above some falling trend line resistance here: The BTK index and PG

Attempting to break above the 28 day moving average is: TMO

Now up against some rising trend line resistance: CBK

Anything posted here may be off base.

Wednesday, May 24, 2006

Daily Update 5/24/06

YI: -1.5

Possible bottom forming in this area for: CDE, PDE, and RMBS

Trying to bottom out here: CLF, IIT, MFE, MTU, and SMTC

Extremely oversold at this point is: MFLX

Standard oversold now: SHI

Moderately oversold at this point: AHO, BAA, the DRG index, EWI, NTES, PPG, RHAT, SKS, and WGII

Trying to hold some rising trend line support: AMN, IRF, and KMX

Trying to hold some falling trend line support: CAKE, CHC, MDT, and MMC

Now trying to break above some falling trend line resistance: BAA, the BKX index, the DJ-30, EWA, EWP, GFI, GOOG, HIT, IIT, MSO, the OEX index, OGE, PHG, RNR, and the S&P-500

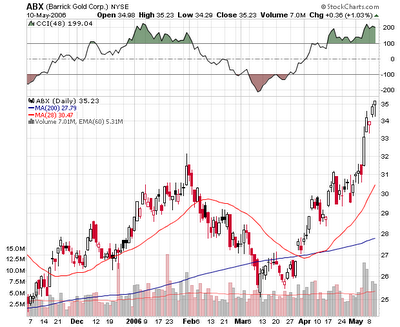

Attempting to break above the 28 DMA here: ABX, AEM, and AMZN

Standard overbought at this point: CPB

To a sell: The XAU index at 3 PM yesterday.

Anything posted here may be off base.

Tuesday, May 23, 2006

Daily Update 5/23/06

YI: -0.5

To a buy: RGLD and the XAU index at 1 PM yesterday.

Trying to bottom out here: AIG, ASA, BKS, BMS, CDE, IBM, KEA, MG135, MOT, PCU, RDC, TKR, WB, and WHR

Standard oversold at this point: EOG, GFI, HIT, and JNPR

Moderately oversold: ABX, CAT, HMC, MFE, OCR, and XLF

Trying to hold some rising trend line support: AEM, COP, DO, ENER, GLW, heating oil, IYM, MTU, N, NFI, RMBS, SWC, TSM, WTS, and the XAU index.

Trying to hold some falling trend line support: MCD

Attempting to hold the 28 DMA here: gold and N

Trying to break above some falling trend line resistance: ADP, EBAY, the E-Mini 500, GPC, MAT, and NST

Attempting to break above the 28 DMA here: MCRS and Q

Moderately overbought at this point: BKC

A break out in either direction is on the way for: STMP

Anything posted here may be off base.

Sunday, May 21, 2006

Saturday, May 20, 2006

Daily Update for 5/22/06

YI: 0 (Right on cue, the YI +0.5/-0.5 area turned out to be an area of support for the market, although it may turn out to be temporary.)

To a buy: FDP and the XAU hourly at 1 PM yesterday.

A possible bottom may be forming here for the IIX and the XCI index.

Trying to bottom out in this general area are: AA, ALEX, AMAT, ARM, AU, BBBY, BPOP, CREE, CSTR, ECA, ENER, FCX, GLW, IWM, KGC, LSS, MG136, NEM, NFI, NG, the OEX index, PDE, PHG, PNRA, REDF, RGLD, RIO, SFY, SIFY, the S&P-500, SPIR, SUN, SWC, THQI, WOR, WY, the XAU index, XLE, XLK, the XOI index, and YHOO

Standard oversold at this point: AMN, the BTK index, CLF, ERICY, FCX, GG, JOSB, NSC, SLV, and the VXO

Moderately oversold now: AEM, APPB, ARM, BKS, the BKX index, BMS, CHK, CLG, the DJ-30, DO, EWA, EWC, EWP, EWU, FTO, GR, HMY, IYM, LSI, MOT, NOK, PBY, PCU, PHI, PLL, PTR, QCOM, RDC, REDF, RIG, SCHW, SHI, SPC, SU, SYMC, TKR, and TTH

Now trying to hold some rising trend line support: BA, BHI, DVY, the E-Mini 500, EWU, GLG, IFN, NSM, NTES, PETM, PG, the 4Q, RHAT, RIG, and XLB

Trying to hold some falling trend line support here: AIG, EOG, and MG135

Attempting to hold on to the 28 day moving average: CMI, gold, and TXU

Now trying to break above some falling trend line resistance: GT, HIT, NWL, SU, VZ, and the XAU hourly.

Moderately overbought now: ENR

A break out in either direction is on the way for: BGF

Anything posted here may be off base.

Friday, May 19, 2006

Daily Update 5/19/06

YI: -0.5

Possible bottom here for: AMTD, CHC, and GNSS

Trying to bottom out in this area: AMZN, the IIX index, and MMC

Standard overold at this point: CAKE and SEE

Moderately oversold: AMAT, BBBY, EWG, EWJ, GT, heating oil, IBM, IDA, KGC, LMT, MTU, NFI, NXL, OXY, POM, RIO, SLE, X, the XAU index, and the XOI index.

Trying to hold some rising trend line support: AAPL, CAT, CHINA, ERF, EWU, FBR, GR, LSS, PPG, TIE, and the XNG index.

Trying to hold some falling trend line support: INTC and XRX

Attempting to hold the 28 DMA here: MCRS and MDC

Anything posted here may be off base.

Thursday, May 18, 2006

Daily Update 5/18/06

YI: 0

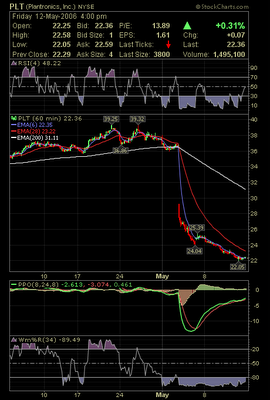

To a buy: PLT

Trying to bottom out: STX

Standard oversold: MRVL

Moderately oversold: AAPL, NEM, RFMD, SIFY, SPIR, TMO, WDC, and WMB

Trying to hold some rising trend line support: ABX, CHK, the E-Mini 500, EWD, EWP, EWQ, GG, GM, IIT, INTU, IYM, MG-136, PHG, RGLD, and XLY

Trying to hold horizontal trend line support: YHOO

Trying to hold falling trend line support: PBY and the XCI index.

Attempting to hold the 28 DMA here: BAC, IFR, and LYO

To a hold for now: MAT

Attempting to break above the 28 DMA here: MDT

Anything posted here may be off base.

Wednesday, May 17, 2006

Daily Update 5/17/06

YI: +2

Trying to bottom out in this area: AMD, AMTD, CY, DJ, ELY, EOG, ERICY, JDSU, JNJ, MER, MSO, NVLS, RMBS, and SNE

Standard oversold at this point are: CDE, SMTC, and SUN

Moderately oversold now: ALEX, AU, COP, ECA, EMC, ENER, ERF, EWD, FCX, GFI, GG, GLG, GRZ, HPQ, IIT, MG-135, MG-136, NG, PDE, SFY, SWC, TASR, TRF, the XAU index, and the XNG index.

Trying to hold some rising trend line support: CLG, CREE, DO, RIG, STMP, and USU

Trying to hold some falling trend line support: ACF, MCRS, and NST

Attempting to hold the 28 DMA here: ABX, EWG, IYM, MFE, NLY, PCU, and WTS

To no position for now: IYM and the XAU index at 2 PM yesterday.

Standard overbought at this juncture: ELN

Anything posted here may be off base.

Monday, May 15, 2006

Daily Update for 5/16/06

YI: +2.5

To a buy: The XAU hourly at the close.

A possible bottom may be forming in this area for the dollar.

This bunch is trying to bottom out here: JNPR, JOSB, JWN, PEG, SBUX, SEE, SMH, TSY, VIGN, the XCI index, and XRX

Standard oversold at this point: CHC and INTC

Moderately oversold now: AA, ASA, DUK, the E-Mini 500, GOOG, HIT, the IIX index, INTU, IWM, KMX, LSS, MER, MMC, MU, NSC, the OEX index, PHG, QQQQ, RGLD, SNE, the S&P-500, TSM, the VXO, WHR, WOR, WY, XLB, XLE, and XLK

Trying to hold on to some rising trend line support: AMAT, AMN, BBBY, BHI, BMS, GG, gold, GYMB, HMY, NFI, OGE, OXY, PLL, PNRA, RDC, RIO, SIFY, SU, X, and XLU

Trying to hold some falling trend line support: The BTK index, DELL, DJ, MSCC, PG, and TTH

Attempting to hold the 28 DMA here are: AEM, ARM, AVP, BA, BHI, C, CAT, the DJ-30, EWA, EWJ, EWP, EWQ, FBR, GR, MCD, PHG, PTR, SNA, TIE, TYC, X, and XLP

To no position for now: JCP, PPG, and TIE

Trying to break above some falling trend line resistance at this point are: MDT and SHI

To a sell: The XAU hourly at 10 AM this morning.

Anything posted here may be off base.

Sunday, May 14, 2006

Daily Update for 5/15/06

YI: +2 (The YI has fallen nicely since it signaled an overbought reading for the market on 5/8/06 with a +4.5 reading... Ideally, we would look for a zero or a plus or minus 0.5 reading before a significant market rally takes place, but there have been times in the past when the YI gapped down below the zero level to an extremely oversold reading, so eventually that will happen once again of course.)

To a buy: MAT and the XAU hourly at 3 PM on Friday.

A possible bottom may be forming in this area for: PLT

These three are trying to bottom out at least temporarily in this area: ADP, PMCS,

and QLGC

Standard oversold at this point are: CSTR, JDSU, RMBS, TSY, and the XCI index.

Moderately oversold now: AIG, AMD, CSCO, CREE, ELY, EOG, GLW, KEA, NSM, NVLS, PNRA, Q, QCOM, RI, SBUX, SMA, STX, TSS, WB, and YHOO

Trying to hold on to some rising trend line support are: AA, ABX, AEM, the BKX index, BMY, CDE, CHK, IBM, IYM, KGC, LMT, LYO, MRK, RADN, RHAT, RNR, SKS, SNDK, SPC, TKR, WOR, and the XNG index.

Trying to hold on to some falling trend line support at this level: AMTD, BPOP, GPC, JOSB, MRVL, THQI, and VIGN

Attempting to hold the 28 DMA here: AAPL, ASA, CBK, CGI, HMC, IDA, IFN, JCP, PDE, SYMC, TZOO, and YCC

To no position for now: IFN

Trying to break above some falling trend line resistance is heating oil...

Anything posted here may be off base.

Friday, May 12, 2006

Daily Update 5/12/06

YI: +3

Trying to bottom out here: MDT

Moderately oversold at this point: MSO

Trying to hold some rising trend line support: AHO, AMN, ASA, DJ, EWG, EWJ, EWQ, HPQ, INTC, MOT, MU, NLY, NTES, NWL, and QCOM

Trying to hold some falling trend line support: EMC, JNPR, SMTC, VZ, WOR, and XMSR

Attempting to hold the 28 DMA here: The DRG index, GE, INTU, RADN, and TMO

To no position for now: MDC

Trying to break above some falling trend line resistance at this point is: ACAS

Now up against some rising trend line resistance: ERF, FXE, and KGC

Moderately overbought now: CLG, REDF, and WMB

Standard overbought at this point: AU, CMI, CUP, EWP, GM, NEM, and the XNG index.

A possible top may be forming in this area for OXY and PCU

To a sell: The XAU hourly at 11 AM yesterday, and TIE

Anything posted here may be off base.

Thursday, May 11, 2006

Daily Update 5/11/06

YI: +4

Moderately oversold at this point: BPOP, STP, and SUN

Trying to hold some rising trend line support at this juncture: AAPL, BAC, ELY, GE, JNPR, NVLS, PHI, RFMD, SMH, and WB

Trying to hold some more rising trend line support here: ERICY

To no position for now: FXE

Trying to break above some falling trend line resistance: EBAY, GFI, heating oil, and JDSU

Attempting to break above the 28 DMA here: F, MCRS, MER, and SPC

Now up against some rising trend line resistance: AEM, CAT, ECA, GG, and PETM

Moderately overbought now: FCX, LSI, MCD, and XLP

Standard overbought at this juncture: CLF, GLG, IIT, WGII, and XLB

Extremely overbought now: EWI and EWU

A possible top may be forming in this area for: AA, KO, and WTS

Probable top here for ABX

To a sell: IYM and JCP

Anything posted here may be off base.

Wednesday, May 10, 2006

Daily Update 5/10/06

YI: +4.5, so the market is getting overbought again.

Trying to bottom out in this area: XMSR

Standard oversold at this point: EBAY

Moderately oversold now: CSTR

Trying to hold some rising trend line support: OCR, SNE, and VZ

Attempting to hold some falling trend line support: MAT

To no position for now: The XAU hourly.

Trying to break above some falling trend line resistance: ALEX, EMC, INTC, PETM, and the XOI index.

Attempting to break above the 28 DMA here: CREE, TTH, and XLK

Now up against some rising trend line resistance: AA, ARM, RADN, and SKS

Standard overbought at this point: FTO

A possible top may be forming in this area: The BKX index, CPB, and IRF

To a sell: IFN

A break out in either direction is on the way for: SHI

Anything posted here may be off base.

Tuesday, May 9, 2006

Blogger would not let me upload the daily update for a while this morning. In the future when this happens, click on the link below.

http://www.siliconinvestor.com/subject.aspx?subjectid=34804

Daily Update 5/9/06

YI: +4

To a buy: The XAU hourly at noon yesterday.

Trying to bottom out: GNSS

Moderately oversold: QLGC

Trying to hold some rising trend line support: ERF, HMC, LSI, LSS, PBY, PDE, and the XAU index.

Attempting to hold the 28 DMA here: AU and NEM

Trying to break above some falling trend line resistance: NTES, TSY, WON, and the XNG index.

Attempting to break above the 28 DMA here: AMTD, JOSB, MOT, NST, SIFY, and THQI

Now up against some rising trend line resistance: BAC, the BKX index, GE, MU, NSM, RIG, and XLF

Moderately overbought at this point: AMAT, HPQ, TYC, and XLU

Standard overbought: The E-Mini 500, MTU, the OEX index, OGE, PLL, and TSM

Extremely overbought: ABX, EWG, RWJ, IRF, and PTR

A possible top may be forming in this area for: BA, C, CAT, the DJ-30, DVY, GT, HIT, and NWL

Probable top here: EWQ

To a sell: FXE

A break out in either direction is on the way for: LMT

Anything posted here may be off base.

Monday, May 8, 2006

Daily Update 5/8/06

YI: +4

Trying to bottom out in this area: F and RGLD

Moderately oversold at this point: JDSU and PG

Attempting to hold some rising trend line support: GFI, heating oil, KGC, SUN, and TRF

To no position for now: AEM and JCP

Trying to break above some falling trend line resistance: ABS, AMD, the BTK index,

GOOG, LMT, MCD, MRK, PEG, PNRA, SGP, SHI, SMH, SNDK, WHR, and XLE

Attempting to break above the 28 DMA here: DJ

Now up against some rising trend line resistance: The DJ-30, FXE, IYM, RIO, SBUX, and TMO

Moderately overbought at this point: APPB, CLF, MG135, MO, NSC, RHAT, SGDE, and the XAU index.

A possible top may be forming in thia area for: CBK and SYMC

Probable top here for: GYMB

To a sell: The XAU hourly at 11 AM on Friday.

A break out in either direction is on the way: CHC, PBY, and TKR

Anything posted here may be off base.

Friday, May 5, 2006

Daily Update 5/5/06

YI: +3

Trying to bottom out in this area: TSY

Standard oversold at this point: GNSS

Moderately oversold: ACAS, ALEX, CDE, silver, PMCS, and RMBS

Trying to hold some rising trend line support: ACF, ECA, ERICY, EWC, FTO, KMX, NG, and SU

Attempting to hold horizontal trend line support: BBBY and ENR

Attempting to hold the 28 DMA here: AHO and TKR

Trying to break above some falling trend line resistance: HPQ, THQI, and XMSR

Now trying to break above horizontal trend line resistance: BGF and MCRS

Attempting to break above the 28 DMA here: KEA

Now up against some rising trend line resistance: EWQ

Moderately overbought now: NI and WTS

Standard overbought at this point: QCOM and RNR

Probable top here for: IFN

To a sell: PPG

Anything posted here may be off base.

Thursday, May 4, 2006

Daily Update 5/4/06

YI: +2.5

To a buy: MDC and the XAU hourly at noon yesterday.

Probable bottom here for: HLR

Trying to bottom out in this area: AMTD and the dollar.

A standard oversold reading at this point for: XMSR

Moderately oversold: GOOG, MSCC, RGLD, and THQI

Attempting to hold some rising trend line support: ARM, FCX, GE, NEM, and PCU

Trying to hold falling trend line support: AMZN and PG

Attempting to hold the 28 DMA here: GRZ, PNRA, and SGP

To no position for now: The XAU hourly at 10 AM yesterday.

Trying to break above some falling trend line resistance: SNE

Attempting to break above the 28 DMA here: CLF and LSS

Now up against some rising trend line resistance: AU, DO, ECA, and EWJ

Moderately overbought at this point: SFY, SYMC, and USU

Standard overbought: ABX, EWD, PTR, and SU

Extremely overbought now: RIO and TXU

A possible top may be forming in this area: BAA, BHI, ERF, KGC, OXY, and TRF

Probable top here for: gold, GG, and X

To a sell: AEM

Anything posted here may be off base.

Wednesday, May 3, 2006

Daily Update 5/3/06

YI: +3

To a buy: The XAU hourly at 2 PM yesterday.

Trying to bottom out in this area: SEE and the XCI index.

Standard oversold at this point: FDP

Moderately oversold: MCRS, MER, and PETM

Attempting to hold some rising trend line support: AHO, silver, MOT, WY, XLK, and YCC

Trying to hold falling trend line support: The BTK index, F, and MDC

Attempting to hold the 28 DMA here: KMX, MSO, PLT, and SCHW

To no position for now: GG and TIE

Trying to break above some falling trend line resistance: CHK, KEA, STP, and the YI.

Attempting to break above the 28 DMA here: ELY

Now up against some rising trend line resistance: ASA

Moderately overbought at this point: AU and Q

Standard overbought now: CPB and ERF

A possible top may be forming in this area: IYM and LYO

To a sell: JCP

Anything posted here may be off base.

Tuesday, May 2, 2006

Daily Update 5/2/06

YI: +2

Extremely oversold at this point is the dollar.

Moderately oversold: MAT and SEE

Trying to hold some rising trend line support here: BMY, IIT, NOK, and WHR

Trying to hold falling trend line support: WON

Attempting to hold the 28 DMA here: CMI and GLW

Trying to break above some falling trend line resistance: BKS, DUK, RNR, and SYMC

Attempting to break above the 28 DMA here: AIG and NXL

Now up against some rising trend line resistance: EWU, gold, IRF, and KGC

Moderately overbought at this point: BGF, the DRG index, DVY, GE, MFE, OCR, QLGC, SKS, and WDC

Standard overbought: AVP, BAA, BAC, the BKX index, C, CGI, NFI, SNA, and WB

Extremely overbought: EWA, FXE, and TRF

A possible top may be forming in this area: EWI, EWP, and PHI

To a sell: The XAU index at noon yesterday.

Anything posted here may be off base.

Monday, May 1, 2006

Daily Update 5/1/06

YI: +3

To a buy: The XAU hourly at 10 AM on Friday.

A possible bottom may be forming in this area for DELL and MDC

These four stocks are trying to bottom out: CHC, CLF, LSS, and SIFY

Moderately oversold at this point: GPC, NTES, WOR, WTS, and WY

Attempting to hold some rising trend line support: ADP, CSTR, IFN, PETM, PHG, and SHI

Trying to hold falling trend line support: MCRS and REDF

Attempting to hold the 28 DMA here: AA, ENER, heating oil, INTU, IWM, NG, PBY, RDC, SGDE, SNE, SWC, and VIGN

Trying to break above some falling trend line resistance: ABS, CPB, DJ, EOG, SNDK, and TTH

Attempting to break above the 28 DMA here: LSI

Now up against some rising trend line resistance: SCHW

Moderately overbought at this point: AAPL, FBR, NWL, and PG

Standard overbought: LYO

Extremely overbought: BHI

A possible top may be forming in this area: TMO

Anything posted here may be off base.