YI: +1.5

To a buy: FLEX, MFST, and PLT

Possible bottom here: SLE

Trying to bottom out now: CPN and MRK

Moderately oversold here: HIT and MDT

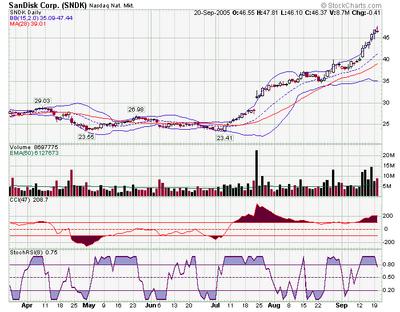

Now trying to hold some rising trend line support: MU, PLUG, RDC, SNDK, and X

Now trying to hold some falling trend line support: GLW, MSO, and TSY

Now attempting to hold the 28 DMA: BGO and the VXO

To no position for now: XNG and XOI

Now trying to break above some falling trend line resistance: AC, AEM, EMC, GM, IDC, NWL, PETM, POM, RAI, WY, and XLK

Now attempting to break above the 28 DMA: ALTI, QLGC, SNA, and UST

Moderately overbought here: AMD and JDSU

Up against some rising trend line resistance here: MO

Possible top here: TIE

Anything posted here may be way off base of course, due to the imperfect nature of technical analysis work.

Thursday, September 29, 2005

Signals $ Opinions

Wednesday, September 28, 2005

Signals $ Opinions

Yogi Index: +1.5

To a buy: GYMB and the XAU hourly at 3 PM yesterday.

Trying to bottom out now: WB

Moderately oversold here: NI

Now trying to hold on to some rising trend line support: Gold the precious yellow, PCL, and XMSR

Now trying to hold some falling trend line support: EMC and KEA

Now attempting to hold the 28 DMA: MER and SATC

To hold for now: SMTC

Now trying to break above some falling trend line resistance: AMZN, BA, ELN, IBM, JCP, JNPR, JOSB, MFE, PBI, SFP, and SYMC

Now attempting to break above the 28 DMA: F, GR, and STMP

Overbought now: PCU

Extremely overbought now: FCX and N

Possible top here: NTES and WOR

Probable top here: RIO

Break out in either direction on the way relatively soon: ABS, EWU, and MAGS

And as is always the case of course due to the imperfect nature of technical analysis, anything posted here may be way off base.

Tuesday, September 27, 2005

Signals $ Opinions

Yogi Index: +1.5

To a buy: AHO

Trying to bottom out here: DD, JNPR, MCRS, and SGP

Oversold at this point: AA

Moderately oversold: GE, MSO, and WTZ

Trying to hold some rising trend line support here: ASA, BGO, BPOP, ECA, KGC, PMCS, RIG, and the XAU index.

Now attempting to hold the 28 DMA: RIG

To no position for now: BBBY and HAL

Trying to break above some falling trend line resistance at this point in time: AIG, AMCC, APPB, ARM, BMS, CCC, CREE, ENR, EWG, SNA, and SVM

Now attempting to break above the 28 DMA: CGI, EBAY, PNRA, and SMTC

Moderately overbought now: LVLT

Overbought now: GOOG and QCOM

Possible top here: The Dollar and NSC

Break out in either direction on the way relatively soon: VIGN

And of course, due to the imperfect nature of technical analysis work, anything posted here may be way off base.

Monday, September 26, 2005

Near Death

When a man lies near death, he thinks not of gold or silver or riches, but instead struggles to mount a near mint condition print of the old Kung Fu TV series on the projector, to see REAL "HDTV" on the silver screen...

Thank you Bruce Lee, for starting the ball rolling on this great series, and as good as David Carradine was in the starring role of "Caine", just think how great it would have been if the then racist network television executives had allowed you to have the leading role. Thank you.

Signals & Opinions

Yogi Index: +1

To a buy: GNSS, SEE, and WHR

Possible bottom here: AVP, BKS, CGI, GM, RFMD, and TQNT

Trying to bottom out now: AMAT, BKX index, DPH, ENR, GYMB, IRF, KEA, KLIC, PBI, PETM, TSS, TSY, UST, VZ, and the XCI index.

Oversold at this point: ALTI, FBR, NFI, and PLL

Moderately oversold now: AC, BGF, BMY, CTXS, ELN, GLW, MRVL, OGE, SYMC, and TLK

Trying to hold some rising trend line support here: ASIA, CMI, DUK, DYN, EWU, OSX index, PDE, SFP, SNE, and TXU

Trying to hold some falling trend line support: ABY and JNPR

Attempting to hold the 28 DMA at this point: DO, LSS, RDC, RGLD, and SFY

Trying to break above the 28 DMA here: CAKE, INTU, SBUX, and TKR

Up against some rising trend line resistance here: FTO

Possible top here: DBLE

To a sell here: XNG and XOI index.

Break out in either direction should arrive relatively soon: BCON

And as is always the case of course, anything posted here may be way off base due to the imperfect nature of technical analysis as a timing device.

Friday, September 23, 2005

Signals $ Opinions

Yogi Index: +1

To a buy: BBBY and SKS

Possible top here: BMS, DELL, FLEX, IBM, NWL, and RHB

Trying to bottom out now: ACF, AVP, BPOP, CBK, CREE, GR, KO, MAT, PLT, PPG, RFMD, SEE, SNA, TASR, TQNT, and WTS

Oversold now: CGI, CPN, JCP, KLIC, MVL, PPG, and RI

Moderately oversold now: AMAT, AMZN, BAC, BBA, BKS, BKX index, BMS, CCC, CPB, CY, DJ-30, DRG index, DVY, GPC, HLR, IRF, IWM, JOSB, LMT, MAT, MSCC, NDX index, NST, NXL, OEX index, PBI, PVN, SFA, SMH, THQI, the VXO, WB, WHR, the XCI index, and XLE

Trying to hold some rising trend line support: AAPL, AMN, BFLY, BTK index, E-Mini 500, EWD, IDA, LYO, MRK, MSFT, PBY, PHG, SLR, S&P-500, TYC, TZOO, and XEL

Trying to hold some falling trend line support here: ACAS, APPB, FBR, NFI, RADN, TSS, TSY, and YCC

Now attempting to hold the 28 DMA: C, ERICY, EWU, HIT, HMC, the MEX index, MO, NOK, PCL, SCH, SFP, SU, SUNW, the UTY index, and WY

Trying to break above some falling trend line resistance here: ASIA and GOOG

Moderately overbought now: CDE and PHI

Overbought now: DBLE and WOR

Possible top here: GFI and Gold the precious yellow.

To a sell: HAL

All of the previous disclaimers apply to the above work.

Thursday, September 22, 2005

Signals & Opinions

YI: +0.5

Possible bottom here: WDC

Trying to bottom out now: FLEX, GM, INTC, and LSI

Extremely oversold at this point: AVP

Oversold: AHO, ARM, DPH, GYMB, and WTS

Moderately oversold at this point: SNA

Trying to hold some rising trend line support here: AEM, BPOP, ETS, EWM, FDP, GG, JWN, KO, MSCC, NTES, QLGC, SKS, and TE

Trying to hold some falling trend line support here: AA, CAKE, and SEE

Attempting to hold the 28 DMA at this point: AMD, AMTD, FDP, the IIX index, LU, MDT, MOT, MU, SPIR, WTZ, and X

To no position for now: EOG

To hold for now: SPC

Now trying to break above some falling trend line resistance: CIEN, EWP, SBUX, SVM, and YAKC

Attempting to break above the 28 DMA here: ADP and NTAP

Overbought at this point: NSC

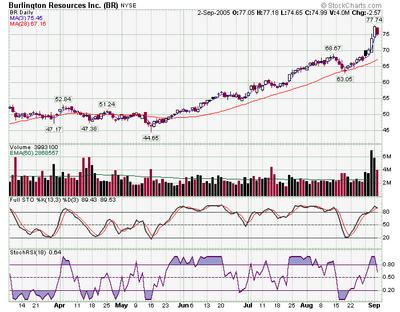

Extremely overbought now: BR, ENER, MTF, OXY, and XLE

Up against some rising trend line resistance here: ENER

Possible top here: BHI

A break out in either direction should be here relatively soon: EWM

And of course, due to the nature of technical analysis work which is an imperfect art, anything posted here may be way off base...

Wednesday, September 21, 2005

Signals $ Opinions

YI: +1.5

To a buy: SMTC

Trying to bottom out now: F, NLY, NVLS, PLL, and WDC

Oversold at this point: CREE, ENR, GM, and SKS

Moderately oversold: BA, GR, LSI, MSFT, RFMD, and YHOO

Now trying to hold some rising trend line support: AMN, EOG, IRF, JCP, LMT, MDC, the NDX index, OXY, the 4Q, RGLD, SO, and THQI

Now trying to hold some falling trend line support: STMP

Attempting to hold the 28 DMA: CAT, CTXS, and XMSR

To no position for now: AMN

Attempting to break above some falling trend line resistance here: CARS, EBAY, EMC, EWM, FBR, PHG, PNRA, RAI, and the VXO

Now trying to break above the 28 DMA: PTR

Moderately overbought here: The Dollar and PDE

Standard overbought here: DO and Gold the precious yellow stuff. :)

Extremely overbought now: RIG, TRF, and TXU

Now up against some rising trend line resistance: EWJ, HPQ, SGDE, and XLE

Possible top here: C, MO, the OSX index, QCOM, and RDC

Probable top here: AAPL and ECA

To a sell: SNDK

And finally, a breakout in either direction should be on the way relatively soon: CSTR

And remember, as is always the case of course, anything posted here could be way off base, due to the nature of technical analysis and or human error.

Tuesday, September 20, 2005

Here are the rest of the daily chart signals and opinions for today:

Oversold: SMTC

Trying to hold some rising trend line support: WHR

To no position for now: SUN

Trying to break above some falling trend line resistance: SPC, T, and USU

Overbought: SWC and TMO

Up against some rising trend line resistance: WMB

Possible top here: SNE and the UTY index.

Signals $ Opinions

Trying to bottom out here: ALTI, ANH, EBAY, and RAI

Extermely oversold now: NLY and PETM

Moderately oversold at this point: KO, PPG, and SGP

Trying to hold some rising trend line support here: ACF, AMAT, BCON, HIT, the IIX index, MFE, NOK, NSM, OCR, SCH, SFA, and SFP

Trying to hold some falling trend line support: FBR and PLL

Attempting to hold the 28 DMA: DRG index, EWD, JOSB, KMX, NSM, and SFA

To no position for now: JNJ and SGP

Trying to break above some falling trend line resistance here: ADP, ALEX, APPB, the BKX index, CSCO, MCD, and PHI

Attempting to break above the 28 DMA now: POM

Moderately overbought at this point: AC, JNJ, and RNR

Overbought now: AEM, EWJ, GFI, HMC, NEM, and PDG

Extremely overbought at this point: RGLD and RIO

Up against some rising trend line resistance here: AAPL, FCX, and the OSX index.

Possible top here: ASA

Probable top here: HUI index

To a sell: EOG

Break out in either direction on the way: EOG

More later...

And of course, due to the nature of technical analysis work, anything posted here may be way off base.

Monday, September 19, 2005

Signals $ Opinions

YI: +3

To a buy: NTAP, PHI, USU, and VZ

Possible bottom here: AHO

Trying to bottom out now: ACAS, APPB, INTC, KLIC, PPG, RHB, and STX

Oversold at this point: ANH, PNRA, and YCC

Moderately oversold: CREE, ELN, GNSS, and PER

Trying to hold some rising trend line support here: AA, AMTD, BR, CIEN, ENER, FLEX, KMX, MSCC, PLUG, SNA, TKR, and WHR

Trying to hold some falling trend line support: EMC, FBR, STMP, and TQNT

Attempting to hold the 28 DMA: AMCC, AMZN, DJ, DYN, GLW, GPC, IRF, IWM, KMX, LYO, MAT, MDT, MSO, the NDX index, NSM, OGE, SSTI, and TSS

To no position for now: EWI, EWP, HAL, HMY, MDC, QCOM, and the UTY index.

Trying to break above some falling trend line resistance here: ENR, FDP, INTU, the OEX index, and Q

Attempting to break above the 28 DMA: CBK, DD, and TZOO

Moderately overbought now: BGO, ETS, MU, and WTZ

Overbought: ABS, DO, HMY, and PCL

Extremely overbought now: AU, MOT, and TXU

Up against some rising trend line resistance here: BHI, CHK, EWJ, HLR, WOR, and XRX

Break out in either direction on the way: AMAT, EWM, MRK, and SPC

And of course, due to the nature of technical analysis, anything posted here may be way off base...

Friday, September 16, 2005

Signals $ Opinions

YI: +2

Possible bottom here: YAKC

Trying to bottom out now: SLE and USU

Oversold now: SEE

Moderately oversold at this point: BPOP, INTC, MCRS, RAI, SLR, and WTS

Trying to hold some rising trend line support here: AMZN, ARM, CIEN, CY, DJ-30, EWG, GR, HLR, INTU, KMX, LVLT, MDT, MMC, MVL, NXL, TIE, and XLK

Trying to hold some falling trend line support: CGI, NWL, PHI, SBUX, and WB

Attempting to hold the 28 DMA here: BGF, CY, DJ-30, DVY, ELN, IFX, LVLT, MCD, MFE, the OEX index, PHG, the 4Q, the S&P-500, SYMC, and VIGN

To hold for now: DPH, STMP, and TASR

Trying to break above some falling trend line resistance at this point: PTR

Attempting to break above the 28 DMA here: KEA

Moderately overbought now: JDSU, SPIR, and WY

Overbought now: ASA and KGC

Extremely overbought at this point: The XAU hourly chart.

Possible top here: GG, MOT, PCL, and SFP

Probable top at this point: SNDK

To a sell signal: MER

And as is always the case of course due to the imperfect nature of technical analysis, anything posted here may be way off base.

Thursday, September 15, 2005

Signals $ Opinions

The below signals and opinions are based on the close of the daily charts of yesterday... Later than usual today because of hurricane Ophelia.

YI: +2

Possible bottom here as of yesterday's close: Heating Oil

Trying to bottom out: ADP, AHO, and NI

Oversold: PLT and YAKC

Moderately oversold: ACU and PHI

Trying to hold some rising trend line support: ALEX, CHINA, HMC, IDC, KO, MTF, N, PLL, SFY, SGP, SLR, TSS, the UTY index, and WMB

Trying to hold some falling trend line support: BMS and USU

Attempting to hold the 28 DMA: BCON, BMY, CDE, DRG index, EWG, EWQ, FCX, IDC, PDE, RDC, RIG, TKR, and TLK

To no position for now: ECA, EWA, NOK, OXY, SKS, and SUNW

To hold for now: GYMB, STMP, and TASR

Trying to break above some falling trend line resistance: ARM, BR, the Dollar, KEA, LSI, and UST

Moderately overbought: ABY, NOK, RHAT, THQI, and TYC

Overbought: AMTD, NTES, SCH, and TMO

Extremely overbought: SNDK

Possible top here: CTXS

To a sell: CAT and QCOM

Anything posted here may be way off base of course, due to the imperfection of technical analysis work and or human error.

Wednesday, September 14, 2005

Signals $ Opinions

YI: +2.5

To a buy: DPH and TASR

Trying to bottom out: AC and AHO

Moderately oversold here: Q

Trying to hold some rising trend line support: BGF, ENR, ERICY, EWM, KLIC, KO, LYO, MCRS, NST, RIG, SWC, and TLK

" " " some falling trend line support: INTC and SMTC

Attempting to hold the 28 DMA: API

To no position for now: AEM and NFI

To hold for now: DD, KLIC, PMCS, and PTR

Trying to break above some falling trend line resistance: AMAT, DD, GPC, KEA, SPIR, and THQI

Attempting to break above the 28 DMA: ACF, BKS, CAKE, CHINA, NWL, and STMP

Moderately overbought now: C, CPN, FDP, GE, NDX index, PBI, and XLK

Overbought now: GOOG

Extremely overbought now: CMI

Up against some rising trend line resistance here: QCOM and TRF

Possible top here: AAOL, ABS, IDA, HUI index, IIX index, IWM, MER, MU, NEM, 4Q, RIO, and the XAU index.

Probable top here: OCR

To a sell: VXO

And anything posted here may be way off base of course, due to the imperfection of technical analysis, and or human error.

Tuesday, September 13, 2005

Here is the rest of the daily chart work for today:

Trying to hold some rising trend line support: Q, SEE, SSTI, and SU

Attempting to hold the 28 DMA: RFMD

To hold for now: RHB

Trying to break above some falling trend line resistance: QLGC, SBUX, and WY

Moderately overbought: XMSR

Overbought: QCOM and WMB

Possible top here: RGLD

To a sell: SUN

Chart of the Day: ECA

http://stockcharts.com/def/servlet/SC.web?c=ECA,uu[l,a]daclyyay[pb28!b200][vc60][iUp10,3,3!Lo15]&pref=G

Signals $ Opinions

YI: +3

Trying to bottom out here: ARM, GM, and POM

Moderately oversold now: EBAY

Trying to hold some rising trend line support: CSTR and MDT

Attempting to hold the 28 DMA: BPOP

To no position for now: BGF

To hold for now: AMCC and INTC

Trying to break above some falling trend line resistance here: APPB, CAKE, and DD

Attempting to break above the 28 DMA: IBM, JCP, KLIC, and NOK

Moderately overbought now: AMCC, BGF, CPB, CSCO, DJ-30, ERICY, HIT, HLR, HMY, HUI index, IRF, IYM, MAT, MDC, MMC, and PMCS

Overbought now: AMD, AU, MCD, and MFE

Extremely overbought now: AAPL, EOG, and MO

Up against some rising trend line resistance here: EWC, IIX index, and MRVL

Possible top here: ASA, CHK, DBLE, DRG index, FTO, LYO, and MSCC

To a sell: ECA, EWA, EWI, EWP, LSS, OSX index, and OXY

Break out in either direction on the way: MAGS

More later...

Anything posted here may be way off base of course.

Sunday, September 11, 2005

Chart of the Day: PTR

http://stockcharts.com/def/servlet/SC.web?c=PTR,uu[h,a]daclyyay[dc][pb4!b28][vc60][iUo77!Lk29]&pref=G

Signals $ Opinions

YI: +3

To a buy: PTR, SPC, and STMP

Trying to bottom out here: RNR and SBUX

Moderately oversold at this point: ENR, NVLS, PHI, POM, and RNR

Trying to hold some rising trend line support: BBA, BMY, TXU, and YHOO

" " " " falling trend line support: GM

Attempting to hold the 28 DMA at this point: ALEX, CCC, and WTS

To no position for now: BR, CREE, DYN, ENER, EWA, EWJ, GFI, JNPR, MTF, and SUN

To hold for now: EMC, STX, and USU

Trying to break above some falling trend line resistance: AA, CGI, THQI, and TLK

" " " " horizontal trend line resistance: GFI, LMT, and the OEX index.

Attempting to break above the 28 DMA at this point: RHB, RMBS, and WTZ

Moderately overbought now: API, DYN, JNPR, MU, PDG, SMH, SUNW, SYMC, TMO, and VIGN

Overbought now: GLW, JOSB, JWN, MSO, and NSM

Up against some rising trend line resistance here: BHI, Gold as in "he loves gold", and FTO

Possible top here: AEM, MO, and SUNW

To a sell: AMN and SGP

Break out in either direction on the way: NTAP

And as is always the case of course, due to the imperfection of technical analysis, anything posted here may be way off base.

Friday, September 9, 2005

For a Few Charts More...

Attempting to hold the 28 DMA: TRF

To a hold for now: YHOO

Attempting to break above the 28 DMA: TYC, WDC, and WHR

Moderately overbought: SNA and TMO

Possible top here: WOR

To a sell: UTY

Chart of the Day: KLIC

http://stockcharts.com/def/servlet/SC.web?c=KLIC,uu[h,a]daclyyay[dc][pb4!b28][vc60][iUo88!Lh25,3]&pref=G

YI: +2.5

To a buy: KLIC and RHB

Possible bottom here: NVLS

Trying to bottom out: DPH

Oversold: SBUX

Moderately oversold: AHO

Trying to hold some rising trend line support: AHO and Heating Oil.

Trying to break above horizontal trend line resistance: GNSS

Attempting to hold the 28 DMA: QLGC and RAI

To no position for now: C, CARS, HPQ, and RHAT

To hold for now: BBBY, CSTR, and DELL

Trying to break above falling trend line resistance: ASIA, ELY, IBM, JCP, JOSB, NTAP, and RHAT

Attempting to break above the 28 DMA: ABY, BKS, F, IYM, MRK, PMCS, and RI

Moderately overbought now: DBLE, DRG index, FLEX, GOOG, IIX index, IWM, JNJ, LU, LYO, MER, NDX index, NXL, OEX index, PHG, 4Q, and SFA

Overbought here: CY, JOSB, JWN, and SGP

Extremely overbought here: PEG

Up against some rising trend line resistance: CMI, CG, KGC, and MU

Possible top here: BTK index and EWG

To a sell signal: EWA, HAL, and the MEX index.

Break out in either direction on the way: NSC

And as is always the case of course, anything posted here may be way off base...

Thursday, September 8, 2005

Chart of the Day: AAPL

http://stockcharts.com/def/servlet/SC.web?c=AAPL,uu[w,a]dacayiay[dc][pb50!b28!f][vc60][iLp5,3,3!Lo22]&pref=G

Signals $ Opinions

YI: +3

To a buy: DD, PMCS, and STX

Trying to hold some rising trend line support here: BCON, BPOP, ENR, and RADN

" " " falling trend line support here: AA

To no position for now: CARS

To hold for now: AA, FBR, and SPC

Trying to break above horizontal trend line resistance: MU

Trying to break above some falling trend line resistance here: AC, ARM, BKX index, CAKE, DJ-30, EBF, KMX, NSC, NSM, PBI, PNRA, RI, TZOO, WY, and XRX

Attempting to break above the 28 DMA now: EMC, FBR, GE, MRK, PLL, and TSY

Moderately overbought now: BGF, CARS, CTXS, DVY, KO, MER, PBY, SNE, SO, S&P-500, and SSTI

Overbought now: AAPL, and MO

Up against some rising trend line resistance here: DBLE, LSS, and PEG

Possible top here: CAT, EWA, EWD, EWI, EWP, EWU, MEX index, SFY, SGDE, and TKR

To a sell: MTF

All of the previous disclaimers apply to the above work.

Wednesday, September 7, 2005

Here is the rest of the daily chart work for today.

To a buy signal: YHOO

Possible bottom here: PMCS, RI, and SLE

Oversold: PNRA

Trying to hold some rising trend line support: PER and PTR

Attempting to hold the 28 DMA: RFMD

Trying to break above some falling trend line resistance: PDG, RI, and TE

Attempting to break above the 28 DMA: PCU, POM, and TE

Moderately overbought: PCL

Overbought: RIO and TKR

Break out in either direction on the way: RHB

Chart of the Day: INTC

http://stockcharts.com/def/servlet/SC.web?c=INTC,uu[h,a]daclyyay[dc][pb4!b28][vc60][iUo47!Lh27,3]&pref=G

Signals $ Opinions

YI: +3

To buy: BBBY, GYMB, and INTC

Possible bottom here: APPB, JCP, and NWL

Trying to bottom out: ARM and ASIA

Oversold: DPH

Moderately oversold: ELY, GM, and NVLS

Trying to hold risising trend line support: BA, DJ, ECA, EWM, MO, and MRVL

Attempting to hold the 28 DMA: GR

To no position for now: BA and OGE

To hold for now: HMY

Trying to break above falling trend line resistance: AC, ACF, ADP, ANH, BFLY, C, CPB, JNPR, MAGS, MCD, and N

Attempting to break above the 28 DMA: BMS, GE, HMY, MDC, and NFI

Overbought: BPOP, ENR, and LSS

Extremely overbought: CAT, CHK, and MSCC

To sell: HPQ

More later.

Anything posted here may be way off base of course.

Sunday, September 4, 2005

Chart of the Day: BR

Finally a top in place?

http://stockcharts.com/def/servlet/SC.web?c=BR,uu[w,a]dacayiay[dc][pb3!b28!f][vc60][iLp13,3,3!Lo18]&pref=G

Saturday, September 3, 2005

Signals $ Opinions

YI: +2

To a buy signal: DYN

Trying to bottom out at this level: AC, ACF, and NWL

Extremely oversold now: RMBS

Oversold at this point: CAKE, JCP, and STX

Moderately oversold here: ADP, the Dollar, DPH, and IBM

Trying to hold some rising trend line support: AMAT, BA, ELY, MCD, NTES, and SNDK

Trying to hold some falling trend line support here: BKS, PLT, and SMTC

Attempting to hold the 28 DMA: KMX

To no position for now: BGF and the XAU hourly chart.

To hold for now: JDSU and YCC

Trying to break above falling trend line resistance: ACAS, AU, CDE, HIT, HMY, JNPR, MRK, PDG, and WTZ

Attempting to break above the 28 DMA now: ANH, BKX index, BMY, CPB, FDP, INTU, NFI, NLY, PHG, T, and TSS

Moderately overbought now: AEM, AHO, BBA, ELN, ETS, EWG, GFI, IDA, IDC, NEM, NI, NXL, SFA, WTS, the XAU index, and XEL

Overbought now: BTK index, EWI, EWP, EWQ, FCX, GG, OXY, PEG, RGLD, UTY index, WMB, and X

Extremely overbought at this point: CAT, EWU, FTO, MOT, SU, TKR, TXU, XNG index, and the XOI index.

Up against some rising trend line resistance here: HMC and PDE

Possible top here: EWC, SGP, and WOR

Probable top here: CHK, ECA, HAL, and XLE

To a sell signal: BR, ENER, Heating Oil, and SUN

And remember, as with any technical analysis which is an iomperfect art, anything posted here could be way off base.

Friday, September 2, 2005

And here are the rest of today's daily chart signals:

To a buy signal: SPC

Oversold: RI

Moderately oversold: SKS and SLE

Trying to hold some rising trend line support: PNRA and WHR

Trying to break above some falling trend line resistance here: PPG, S&P-500, SSTI, VZ, and XRX

Attempting to break above the 28 DMA: RHAT and WHR

Moderately overbought: PLUG, WOR, and XMSR

Overbought: TRF

Extremely overbought: RDC

And as with all technical analysis work under any conditions, anything posted here may be way off base.

Chart of the Day: EMC

http://stockcharts.com/def/servlet/SC.web?c=EMC,uu[w,a]dacayiay[dc][pd15,2!b28!f][vc60][iLd47!Lo23]&pref=G

Signals $ Opinions

YI: +2.5

To buy: AA, EMC, and JNPR

Moderately oversold: AC, ARM, and NWL

Trying to hold some rising trend line support: CTXS and EWM

Attempting to hold the 28 DMA: BCON, MAGS, and MCRS

To no position: IRF

To hold: CSTR

Trying to break above some falling trend line resistance: BKS, CDE, DRG index, E-Mini-500, INTC, LSI, MER, and PCL

Attempting to break above the 28 DMA: BGF, CREE, CSTR, IIX index, JNJ, MAT, MDC, NDX index, NOK, PBI, and PBY

Moderately overbought: ENR and IRF

Extremely overbought: AMN, BHI, LDD, MDT, and the OSX index.

Up against some rising trend line resistance: MO

Possible top here: OCR

More later.

Thursday, September 1, 2005

Chart of the Day: DELL

http://stockcharts.com/def/servlet/SC.web?c=DELL,uu[h,a]daclyyay[dc][pb4!b28][vc60][iUo88!Lh13,3]&pref=G

Signals $ Opinions

YI: +2.5

To a buy signal: AMCC, DELL, HMY, JDSU, MDC, and NOK

Possible bottom here: IYM, SPC, VZ, and WY

Trying to bottom out now: BKS, BKX index, BMS, BMY, CGI, CPB, JNPR, and RHB

Oversold here: BBBY, CAKE, CHINA, and STX

Moderately oversold here: AA, ACF, ADP, ARM, Gold the precious metal, GYMB, IFX, PPG, TMO, and WHR

Trying to hold some rising trend line support here: LSI and VIGN

Trying to hold some falling trend line support: DD, RNR, and SLE

Attempting to hold the 28 DMA now: AMD, CG, DPH, LSI, MCD, and RADN

To no position for now: CCC and CG

Trying to break above some falling trend line resistance here: ABY, EOG, GLW, HLR, KLIC, MEX index, NLY, PMCS, and the XAU hourly.

Attempting to break above the 28 DMA at this point: BGF, CPN, GM, and GOOG

Overbought now: MOT and SGDE

Extremely overbought here: AMN and TRF

Now up against some rising trend line resistance: MRVL, TIE, and the XNG index.

Possible top here: ENER and GNSS

Break out in either direction on the way: AVP, DYN, NTAP, and SWC

Anything posted here may be way off base of course...