Thursday, August 31, 2006

S's & O's based on the closing prices of 8/30/06

YI: +2

Trying to bottom out: NFI and SWC

Moderately oversold: BAA

Trying to hold some rising trend line support: gold, NEM, SYMC, and the XAU index.

Trying to hold some falling trend line support: EOG

Attempting to hold the 28 DMA here: AEM, CHK, CUP, MER, MG135M RHAT, and WB

Trying to break above some falling trend line resistance: AMTD, F, NSC, PDA, RIO, SLE, TASR, and TIE

Attempting to break above the 28 DMA here: CIG and NTES

Now up against some rising trend line resistance: BPOP, CHC, EWA, EWQ, EWU, and the S&P-500

Moderately overbought now: CSTR, GLG, GT, INTC, MFE, OGE, SEE, and SNA

Standard overbought: AMN, MSCC, and TTH

A possible top may be forming in this area for: The BTK index, CSCO, MCD, the OEX index, and WGII

A break out in either direction is on the way for: HIT

And of course, anything posted here may be off base due to human error.

Wednesday, August 30, 2006

S's & O's based on the closing prices of 8/29/06

YI: +2

To a buy: ARM and the XAU hourly at 11 AM yesterday.

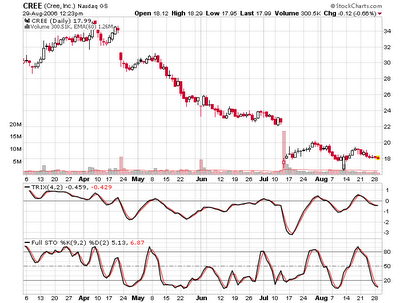

Trying to bottom out: ACF and CREE

Moderately oversold: AU, CBK, JCP, and NFI

Trying to hold some rising trend line support: AAUK, ASA, CLG, EWC, HMY, JNJ, and KGC

Trying to hold some falling trend line support: BHI and FBR

Attempting to hold the 28 DMA here: OXY and PTR

Trying to break above some falling trend line resistance: The BKX index, DJ, IRF, LSI, NSM, PHI, and PLL

Attempting to break above the 28 DMA here: AVP and GOOG

Now up against some rising trend line resistance: ADP, EWD, EWG, and IDA

Moderately overbought: C and INTC

A possible top may be forming in this area for: LYO

A break out in either direction is on the way for: CREE and PCU

More later.

Anything posted here may be off base due to human error.

Tuesday, August 29, 2006

S's & O's based on the closing prices of 8/28/06

YI: +1

A possible bottom may be forming in this area for: LSI and STMP

Trying to bottom out in this area: CREE and SHI

Extremely oversold at this point: FBR

Moderately oversold now: BBBY, CBK, COP, GM, SNE, STP, and WOR

Trying to hold some rising trend line support: CHK, HPQ, MCD, SU, TSM, and the XOI index.

Trying to hold some falling trend line support: BA and the VXO

Attempting to hold the 28 DMA here: AMTD, the BKX index, CY, EWJ, JOSB, KMX, PD, and WTS

Trying to break above some falling trend line resistance: The BTK index, DELL, GLW, JNPR, KEA, MRK, and NX

Attempting to break above the 28 DMA here: GYMB

Now up against some rising trend line resistance: WMB

Moderately overbought at this point: ELN and WB

A possible top may be forming in this area for: SNDK

And of course, anything posted here may be off base due to human error.

Sunday, August 27, 2006

S's & O's based on the closing prices of 8/25/06

YI: +0.5

A possible bottom may be forming in this area for: SKS

Trying to bottom out now: CAKE, NTES, RIO, and STMP

Moderately oversold at this point: BBBY, CAT, CGI, JWN, NSC, PHI, SHI, and SNE

Trying to hold some rising trend line support: AA, AMN, CDE, CHC, EWG, GYMB, MG135, PCU, PEG, SLV, and VIGN

Attempting to hold the 28 DMA here: AAUK, BKS, EWA, FXE, HMC, IWM, MCD, RFMD, RI, TCM, and WTS

Trying to break above some falling trend line resistance here: AAPL, the DRG index, and SMTC

Attempting to break above the 28 DMA: DO

Now up against some rising trend line resistance: KO

Moderately overbought at this point: AMAT and FDP

Standard overbought now: ERF

A break out in either direction is on the way for: DELL, NST, Q, SPC, and TIE

Anything posted here may be off base due to human error.

Friday, August 25, 2006

S's & O's based on the closing prices of 8/24/06

YI: +0.5

Trying to bottom out in this area: ARM, CIG, IRF, LSI, MCRS, MDC, MRVL, PDA, and SBUX

Moderately oversold now: OCR and RIO

Trying to hold some rising trend line support: EBAY, EWQ, GRZ, IDA, MER, NFI, SLE, T2106, THQI, TIE, TMO, TXU, and WOR

Attempting to hold the 28 DMA here: ELY, GNSS, HIT, INTU, MOT, MU, PLL, RNR, SCHW, STP, TASR, and WGII

Trying to break above some falling trend line resistance: INTC and NSM

Attempting to break above the 28 DMA here: MMC and RMBS

Now up against some rising trend line resistance: JNJ

Moderately overbought now: ERF, EWC, and SIFY

Standard overbought: KGC

A possible top may be forming in this area for: ALEX and PG

A break out in either direction is on the way for: BAA, DELL, and N

Anything posted here may be off base due to human error.

Thursday, August 24, 2006

S's & O's based on the closing prices of 8/23/06

YI: +0.5

Trying to hold some rising trend line support in this area: The BKX index, CPB, CSTR, CY, the DRG index, EWI, EWG, GOOG, and SLE

Trying to hold horizontal trend line support: NTES

Attempting to hold the 28 DMA here: GNSS, MOT, and QLGC

To no position for now: PBY

To a hold: SWC

Trying to break above some falling trend line resistance in this area: AMD, BAA, the dollar, gold, GG, and GLG

Attempting to break above the 28 DMA here: AA and MDT

Moderately overbought at this point: BPOP, CLG, EWC, FCX, PBY, REDF, SIFY, and WY

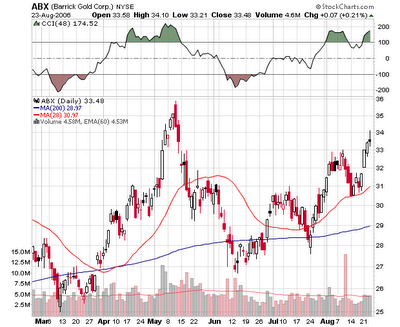

Standard overought now: ABX

Extremely overbought: PEG

A possible top may be forming in this area for: ABX, DVY, and SYMC

Anything posted here may be off base due to human error.

Tuesday, August 22, 2006

S's & O's based on the closing prices of 8/22/06

YI: +1

Trying to bottom out in this area: NTES

Standard oversold at this point: ARM

Moderately oversold now: BA, CIG, PDA, and SHI

Trying to hold some rising trend line support: EWJ, EWP, FXE, MMC, MRVL, PHG, SBUX, and STP

Attempting to hold the 28 DMA here: F

Trying to break above some falling trend line resistance: AAPL, CHK, FDP, Q, and the XAU index.

Attempting to break above the 28 DMA here: BKC

Now up against some rising trend line resistance: KGC and MG135

Anything posted here may be off base due to human error.

S's & O's based on the closing prices of 8/21/06

YI: +1

Trying to hold some rising trend line support: BBBY and ELY

Attempting to hold the 28 DMA here: GM

Trying to break above some falling trend line resistance: AA and EOG

Attempting to break above the 28 DMA here: AMZN and RDC

Now up against some rising trend line resistance: EWP

Moderately overbought at this juncture: ALEX, LYO, the OEX index, PD, REDF, SEE, SYMC, and the VXO

Standard overbought at this point: NVLS and TMO

A possible top may be forming in this area for: ACAS, ADP, AIG, and MER

A break out in either direction is on the way for: ELN

Anything posted here may be off base.

Monday, August 21, 2006

S's & O's based on the closing prices of 8/18/06

YI: +1.5

GFI is trying to bottom out in this area.

OCR and SU are now moderately oversold.

Trying to hold some rising trend line support: AAUK, EWU, GLG, and heating oil.

Attempting to hold the 28 DMA here: CDE, DJ, FTO, PHI, and PTR

To no position: CAKE, EBAY, and JOSB

Trying to break above some falling trend line resistance: BKC and CMI

Attempting to break above the 28 DMA here: GYMB, IFN, MDC, MMC, NSC, PLT, PNRA, and RADN

Now up against some rising trend line resistance: CHC

Now moderately overbought: AMD, BKS, the BKX index, the BTK index, CY, EBAY, IWM, JOSB, MTU, PLL, RHAT, RI, RNR, TYC, TZOO, and WTS

Standard overbought at this point: LYO, MCD, MOT, NXL, PHG, and THQI

A possible top may be forming in this area for: AMN, CSTR, JCP, LMT, and WB

Anything posted here may be off base.

Friday, August 18, 2006

S&O's based on closing prices of 7/17/06

YI: +1

Trying to hold some rising trend line support: AEM, AVP, FBR, GG, MRK, and the VXO

Attempting to hold the 28 DMA here: TXU

To no position for now: AMZN, GLW, INTC, and MRVL

To a hold: EMC, PBY, SMTC, and WON

Trying to break above some falling trend line resistance: ACF, EMC, FXE, GPC, the IIX index, IRF, IWM, MCRS, NSC, NSM, PBY, RMBS, SIFY, SPC, TASR, WHR, and WY

Attempting to break above the 28 DMA here: AMZN, BA, FDP, GOOG, LSS, MFE, SMTC, STX, WON, and X

Moderately overbought now: APPB, BMS, CAKE, the DJ-30, the DRG index, ELY, the E-Mini 500, ERICY, EWA, EWD, EWQ, GE, GLW, HIT, IBM, the IIX index, JWN, MSCC, MU, NOK, NWL, PMCS, PPG, the 4Q, RFMD, SMH, SNDK, the S&P-500, T2106, TKR, TSM, VIGN, WB, the XCI index, and XLK

Standard overbought at this point: AAPL, AMN, AMTD, F, HPQ, IDA, IIT, INTU, MER, the OEX index, STP, and WGII

A possible top may be forming in this area for: AAUK, CSCO, SNA, and XRX

A break out in either direction is on the way: GRZ

Anything posted here may be off base.

Thursday, August 17, 2006

S&O's based on the closing prices of 8/16/06

YI: +1

To a buy: SMTC, SWC, and XMSR

A possible bottom may be forming in this area for: PDE

Standard oversold at this point: NTES

Trying to hold some rising trend line support: SHI and the XAU hourly.

Trying to break above some falling trend line resistance: ALEX, AMAT, BPOP, the BTK index, CLF, GLG, GLW, GM, INTC, LSI, MDC, MRK, RIO, SNE, USU, WOR, and XLF

Attempting to break above the 28 DMA here: ENER, HMY, JNPR, PLT, RHAT, STMP, and YHOO

Now up against some rising trend line resistance: AAUK, EWC, EWP, and KEA

Moderately overbought now: EMC, EWJ, MSO, and SCHW

Standard overbought at this point: JCP, PEG, TSS, and WMB

A possible top may be forming in this area for: AIG

Anything posted here may be off base.

Wednesday, August 16, 2006

S&O's based on the closing prices of 8/15/06

YI: 0

A possible bottom may be forming in this area for: ENER, PBY, and TASR

Trying to bottom out are: ARM, BHI, DO, IFR, MDT, USU, and XMSR

Moderately oversold at this point: BAA, CLF, CLG, EOG, GFI, IYM, NEM, and RIO

Trying to hold some rising trend line support: ASA, GLG, gold, GYMB, IFN, and MG135

Trying to hold some falling trend line support: OXY and RDC

Attempting to hold the 28 DMA here: ABX, AU, CHK, ECA, SU, the XNG index, and the XOI index.

To no position for now: ACAS

Trying to break above some falling trend line resistance: AA, AMN, BMY, C, DVY, MU, RADN, T2104, T2106, TXU, X, XLB, and YCC

Attempting to break above the 28 DMA here: AMD, BKS, CAKE, and QCOM

Now up against some rising trend line resistance: NVLS

Moderately overbought now: AIG and SEE

Standard overbought at this point: TMO

A possible top may be forming in this area for: ADP

Anything posted here may be off base.

Tuesday, August 15, 2006

Here are the rest of today's S&O's.

RMBS is trying to form a bottom.

JNPR, LSI, MDC, and SWC are trying to bottom out at least temporarily.

FDP and PBY are extremely oversold.

ENER and WY are standard oversold.

CUP and OGE are moderately oversold.

GM, GRZ, GT, MRVL, RGLD, the XAU index, and XLE are trying to hold some rising trend line support.

SIFY is trying to hold some falling trend line support.

ERF and FXE are attempting to hold on to the 28 DMA.

CAKE, CREE, ELY, GE, IBM, JWN, MCRS, PEG, QCOM, QQQQ, RHAT, STMP, TYC, TZOO, and the XCI index are trying to break above some falling trend line resistance.

PLL is trying to break above the 28 DMA.

CSTR is moderately overbought.

CPB, GNSS, and MO may be forming a top here.

EWJ and MTU should have a breakout in either direction coming up.

Anything posted here may be off base.

S&O based on closing prices of 8/14/06

YI: -1.5

To a buy: BKC

A possible bottom may be forming in this area for: BMY

Gold is trying to hold some rising trend line support.

AEM is trying to hold the 28 DMA.

AIG is trying to break above some falling trend line resistance.

ADP is up against some rising trend line resistance here.

BGF is standard overbought now.

A break out in either direction is on the way for: AMD

More later.

Anything posted here may be off base.

Monday, August 14, 2006

Sunday, August 13, 2006

S&O based on closing prices of 8/11/06

YI: -1.5

To a buy: EMC and GLW

Trying to bottom out now: BA, BKC, and RIG

Standard oversold at this point: SWC and WDC

Moderately oversold now: BHI

Trying to hold some rising trend line support: CLF, ERF, ERICY, FCX, NLY, OXY, RIO, SPIR, SUN, TXU, and VIGN

Trying to hold some falling trend line support: CREE

Attempting to hold the 28 DMA here: CMI, DELL, the DRG index, GM, gold, heating oil,

RGLD, and SGP

To no position for now: BAC

Trying to break above some falling trend line resistance: ACF, INTU, and TRF

Now up against rising trend line resistance: MO

Moderately pverbought at this point: JCP

To a sell: The XAU hourly at 11 AM on Friday.

A break out in either direction is on the way for: AMAT and INTC

Anything posted here may be off base.

Friday, August 11, 2006

Update opinions based on closing prices of 8/10/06

YI: -1

Possible bottom here for: BKS

Trying to bottom out: PLT, QCOM, SPC, STX, TIE, and WDC

Extremely oversold: PNRA and TSY

Standard oversold: ACF, BA, and SBUX

Moderately oversold: The BTK index, CAT, GPC, IRF, and IWM

Trying to hold some rising trend line support: AMD, BBBY, BHI, JOSB, LSI, N, NFI, NVLS, SFY, SLV, SU, T2106, TTH, WHR, XLK, the XOI index, XRX, and the YI

Trying to hold horizontal trend line support: GR

Trying to hold some falling trend line support: CAKE, JNPR, PDE, PLL, and SMTC

Attempting to hold the 28 DMA: AAPL, the BKX index, BPOP, CHC, CY, the DJ-30, DO, the E-Mini 500, MAT, MCD, NXL, the OEX index, PHI, the S&P-500, WTS, XLF, and XMSR

To no position for now: CSCO

Trying to break above some falling trend line resistance: GYMB, MTU, SHI, and SIFY

Moderately overbought: CSCO

A break out in either direction is on the way: EWA

Anything posted here may be off base.

Thursday, August 10, 2006

Update based on closing prices of 8/9/06

YI: -1.5

To a buy: WON and the XAU hourly at 10 AM yesterday.

Trying to bottom out here: CREE, PDE, RADN, and RHAT

Standard oversold at this point: MCRS, RIG, and X

Moderately oversold: STX

Trying to hold some rising trend line support: ALEX, AMTD, CBK, CGI, CMI, NFI, NWL, and SLE

Trying to hold some falling trend line support: FDP, GE, and RNR

Attempting to hold the 28 DMA here: EWD and PCU

To no position: The XAU hourly at 1 PM yesterday.

To a hold for now: CAKE and EBAY

Trying to break above some falling trend line resistance: CPB, OCR, and RFMD

Trying to break above horizontal trend line support: The XAU index.

Attempting to break above the 28 DMA here: EBAY and the IIX index.

Now up against some rising trend line resistance: FTO, HMC, SLV, and VZ

Moderately overbought: SHI

A possible top may be forming in this area for: JNJ, PG, and SUN

To a sell: ACAS

A break out in either direction is on thye way for: EMC

Anything posted here may be off base.

Wednesday, August 9, 2006

Update based on closing prices of 8/8/06

YI: -1

Standard oversold: BMY

Moderately oversold: ERICY and HMY

Trying to hold some rising trend line support: AU, FXE, NSM, and XLU

Trying to hold some falling trend line support: SWC

Attempting to hold the 28 DMA here: COP, INTU, and SCHW

Trying to break above some falling trend line resistance: The VXO and YHOO

Attempting to break above the 28 DMA here: APPB, BGF, and SEE

Moderately overbought: Heating oil.

Anything posted here may be off base.

Tuesday, August 8, 2006

Update based on closing prices of 8/7/06

YI: -0.5

Standard oversold: IFN

Moderately oversold: The dollar, DO, INTC, and MDT

Trying to hold some rising trend line support: The BKX index, C, CPB, EWU, GE, GFI, HPQ, JNJ, KMX, LMT, MRK, PCU, PLT, SKS, and TIE

Trying to hold some falling trend line support: PDE and WDC

Attempting to hold the 28 DMA here: AIG, EWA, POM, SFY, and WOR

To a hold for now : MRVL

Trying to break above some falling trend line resistance: APPB and EMC

Attempting to break above the 28 DMA: MFLX and QLGC

Moderately overbought: F, LYO, MG135, and NLY

Possible top here: ACAS

To a sell: TXU

A break out in either direction is on thye way for: GE and RFMD

Anything posted here may be off base.

Monday, August 7, 2006

Daily update baswed on closing prices of 8/4/06

YI: 0

Standard oversold: MFE

Trying to hold some rising trend line support: ABX, BAA, GR, POM, SFY, WOR, and X

Trying to hold some falling trend line support: RIG

Attempting to hold the 28 DMA here: KO

To no position: AMD and BBBY

Trying to break above some falling trend line resistance: ACF, AMAT, BKS, BPOP, CAKE, CREE, EBAY, GT, IWM, JOSB, RI, SMH, and TKR

Attempting to break above the 28 DMA here: ALEX, AMD, GE, MDC, NTES, and PETM

Up against some rising trend line resistance: MER, NFI, SPC, and VIGN

Moderately overbought: ADP, AMN, ASA, BBBY, CAT, CBK, EWG, HPQ, IIT, RIO, SUN, WB, WGII, and WTS

Standard overbought: BKX index, CMI, KMX, and PG

Possible top here: CDE, THQI, and TSS

A break out in either direction is on the way: UMC

Anything posted here may be off base.

Friday, August 4, 2006

Here is the rest of today's TA work.

Moderately oversold: RNR and TZOO

Trying to hold some rising trend line support: MO, MTU, and NST

Attempting to hold the 28 DMA: MSO

Trying to break above some falling trend line resistance: PMCS, PPG, SEE, and WB

Attempting to break above the 28 DMA: IYM, JCP, LSI, and OCR

Moderately overbought: MG136, SLE, SLV, and STP

Standard overbought: Q

Possible top here: The XNG index.

Anything posted here may be off base.

Update base on closing prices of 8/3/06

The YI is still at the zero line, waiting for a breakout in either direction for the market.

To a buy: EBAY

A possible bottom may be forming in this area for: EMC and GLW

Trying to bottom out now: AVP, BMY, CSCO, and GOOG

Trying to hold some rising trend line support: AEM and HMY

Attempting to hold the 28 DMA: EOG

Trying to break above some falling trend line resistance here: CGI, DELL, and FBR

Now up against some rising trend line resistance: AAUK and heating oil.

Moderately overbought now: AU, CDE, and EWC

A possible top may be forming in this area for: ABX

To a sell: BAC and the XAU hourly at 10 AM yesterday.

More later.

Anything posted here may be off base.

Thursday, August 3, 2006

Update based on the closing prices of 8/2/06

YI: 0

To a buy: CAKE

Trying to bottom out: ACF

Trying to hold some rising trend line support: NVLS, SMTC, SNE, TRF, and the VXO

Trying to hold some falling trend line support: APPB, the dollar, PBY, and PETM

Attempting to hold the 28 DMA here: NWL and OGE

To no posistion for now: BAC, GT, TXU, and WTS

Trying to break above some falling trend line resistance: ADP, CLF, the E-Mini 500, HMY, gold, RIG, SPC, and SU

Now up against some rising trend line resistance: FTO

Moderately overbought now: FCX, GLG, KGC, the XAU index, and XRX

Standard overbought: XLE

Extremely overbought: NST

A possible top may be forming in this area for: KEA

A break out in either direction is on the way for: ENER

Anything posted here may be off base.

Wednesday, August 2, 2006

Update based on the closing prices of 8/1/06

YI: -0.5

To a buy: The XAU hourly at 11 AM yesterday.

Extremely oversold: BKS

Standard oversold: FBR

Moderately oversold: AVP and BMY

Trying to hold some rising trend line support: CHC, GE, HMY, IFN, INTU, NXL, and NWL

Trying to hold some falling trend line support: FDP and SBUX

Attempting to hold the 28 DMA here: PEG and YCC

To a hold for now: AMZN, BBBY, CSCO, and FDP

Trying to break above some falling trend line resistance: GT, NTES, and RMBS

Attempting to break above the 28 DMA here: AMAT, CUP, ELN, IRF, and JWN

Standard overbought now: AAPL and ERF

Extremely overbought: N

A possible top may be forming in this area for: AHO, CHK, MOT, and SFY

Anything posted here may be off base.

Tuesday, August 1, 2006

Daily update based on closing prices of 7/31/06

YI: 0

Trying to bottom out: NTES and TASR

Moderately oversold: SVU

Trying to hold some rising trend line support: BA and NEM

Trying to hold some falling trend line support: AVP

To no posiition for now: AMTD and the XAU hourly.

To a hold: AMD and STMP

Trying to break above some falling trend line resistance: ALEX, AMD, CDE, the E-Mini 500, FDP, GRZ, LSI, MCD, PLL, QCOM, SPIR, XLB, and XLK

Trying to break above horizontal trend line resistance: The DJ-30 and NLY

Attempting to break above the 28 DMA here: ADP, BPOP, DELL, GE, INTC, NSM, QQQQ, RGLD, SWC, TIE, TYC, UMC, XMSR, and XRX

Up against some rising trend line resistance: XRX

Moderately overbought now: AAUK, ABX, BMS, EWI, EWQ, FXE, GNSS, MER, NVLS, PCU, SCHW, the S&P-500, TMO, VZ, and XLE

Standard overbought: CHK and JNJ

A possible top may be forming in this area for: ECA, EWP, MO, PHG, SNE, and TTH

To a sell: BAC

A break out in either direction is on the way for: ASA

Anything posted here may be off base.