Friday, June 30, 2006

Daily Update 6/30/06

YI: 0

To a buy: AMD, BBBY, CREE, and ELY

Trying to bottom out: APPB, PBY, PLL, PMCS, SLE, SNDK, STMP, and YCC

Trying to hold some rising trend line support: GYMB and PEG

Trying to hold some falling trend line support: RFMD

Attempting to hold the 28 DMA: HPQ and PNRA

Trying to break above some falling trend line resistance: ARM, AVP, EBAY, ERICY, GE, IDA, LSI, MMC, PHI, PLT, SNE, STX, SVU, TIE, TSY, USU, WDC, and WTS

Trying to break above horizontal trend line resistance: CBK

Attempting to break above the 28 DMA: SWC, THQI, and TSM

Up against some rising trendline resistance: VZ

Moderately overbought: NXL, STP, and WMB

Standard overbought: ECA and INTU

Possible top here for: FBR

A break out in either direction is on the way for: GNSS

Anything posted here may be off base.

Thursday, June 29, 2006

Daily Update 6/29/06

YI: +2.5

To a buy: ALEX, GT, and the XAU hourly.

Possible bottom here: PHI

Trying to bottom out: AMAT, BBBY, EBAY, IBM, NSM, and SMH

Moderately oversold: The BTK index, JNPR, and YCC

Trying to hold some rising trend line support: AEM, BGF, ENR, EWC, IYM, LSS, RIO, SHI, WY, XLB, and XRX

Trying to hold horizontal trend line support: SEE

Trying to hold some falling trend line support: AMTD, CAKE, the DRG index, MOT, QQQQ, and STMP

Attempting to hold the 28 DMA: AHO

To a hold for now: RMBS

Trying to break above some falling trend line resistance: FDP, GLW, the S&P-500, and SU

Attempting to break above the 28 DMA: LYO, MTU, OCR, SUN, and VIGN

Moderately overbought: SFY

Anything posted here may be off base.

Tuesday, June 27, 2006

Daily Update for: 6/28/06

YI: -3

Trying to bottom out: AMD and DJ

Trying to hold some falling trend line support: EMC, MRVL, and SYMC

Trying to break above some falling trend line resistance: ECA, MCRS, MG136, TKR, TYC, and XLE

Attempting to break above the 28 DMA: ABX, BMS, CSTR, DO, EWC, FCX, IYM, MTU, NEM, NFI, PCU, PDE, WGII, WY, and XMSR

Up against some rising trend line resistance: OGE

Moderately overbought: CLG, CMI, ELN, EOG, ERF, FBR, FTO, LSS, N, OXY, X, the XOI index, and YHOO

Standard overbought: KMX

Possible top here: AU

To a sell: The XAU index at noon on the 27th.

A break out in either direction is on the way: ADP and BAC

Anything posted here may be off base.

Monday, June 26, 2006

Daily Update for: 6/27/06

YI: -2

Possible bottom here: SMTC

Trying to bottom out: BKX index, ELY, GE, and PBY

Standard oversold: QCOM

Moderately oversold: BBBY

Trying to hold some rising trend line support: ADP and JNJ

Trying to hold some falling trend line support: NSM

Attempting to hold the 28 DMA: TTH

To a hold for now: JOSB

Trying to break above some falling trend line resistance: APPB, the dollar, EWP, KEA, LYO, MER, OCR, POM, RGLD, RHAT, RIG, TASR, THQI, TMO, and TSM

Attempting to break above the 28 DMA: AA, CLF, KGC, MSO, PTR, RADN, SFY, and SU

Moderately overbought: HMY, NTES, and WOR

Possible top here: JCP

Anything posted here may be off base.

Daily Update 6/26/06

YI: -2.5

To a buy: RMBS and the XAU hourly at 10 AM on Friday.

Trying to bottom out: CSTR, EMC, F, and MOT

Standard oversold: MMC

Moderately oversold: GE and MDT

Trying to hold some rising trend line support: ABX, DVY, JDSU, NOK, TYC, and XLU

Trying to hold some falling trend line support: AMAT and SMTC

To no position for now: The XAU hourly.

Trying to break above some falling trend line resistance: AMD, BKC, CAKE, COP, GLG, gold, MFE, MU, WDC, WMB, WTS, the XNG index, and the XOI index.

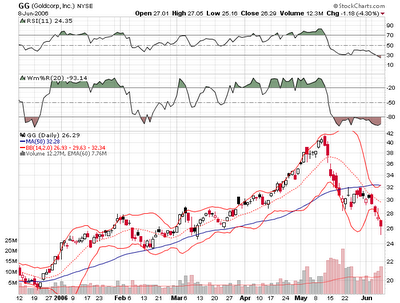

Attempting to break above the 28 DMA: ARM, ASA, ERF, FTO, GFI, GG, heating oil, MDC, MFLX, STP, TIE, USU, the XAU index, and XLE

Moderately overbought: CUP, GM, and PNRA

A break out in either direction is on the way for: EBAY, TSY, and XMSR

Anything posted here may be off base.

Friday, June 23, 2006

Daily Update 6/23/06

YI: -2.5

Trying to bottom out: SPC

Standard oversold: RI

Moderately oversold: SLE

Trying to hold some rising trend line support: BGF, PLT, TTH, and TXU

Trying to hold some falling trend line support: BBBY

Attempting to hold the 28 DMA: The dollar

Trying to break above some falling trend line resistance: CMI, CY, DO, EWA, EWJ, EWU, GRZ, IYM, MDC, PETM, RADN, STP, and SUN

Attempting to break above the 28 DMA: ACF, AEM, AMAT, AU, the DJ-30, EWG, EWI, EWQ, FXE, GLG, GNSS, IFN, NG, NSC, QLGC, RIO, THQI, TZOO, XLK, XRX, and YHOO

Moderately overbought: CPB

To a sell: The XAU hourly at 10 AM yesterday.

Anything posted here may be off base.

Thursday, June 22, 2006

Daily Update 6/22/06

YI: -2

To a buy: CDE, JOSB, and the XAU hourly at 10 AM yesterday.

Possible bottom here for: BAA, DELL, and EBAY

Trying to bottom out in this area: AA, BKS, CAKE, CLF, EWC, N, PETM, PHI, PLL, SMTC, and YCC

Trying to hold some rising trend line resistance here: MCRS and Q

Trying to hold some falling trend line support: RIG and WHR

Attempting to hold the 28 DMA: XLU

Trying to break above some falling trend line resistance here: ALEX, EWD, the E-Mini 500, FTO, MRK, NEM, RGLD, RMBS, SLV, SNA, SU, TRF, WB, WGII, and WY

Attempting to break above the 28 DMA: HMC, the IIX index, MG135, PHG, QQQQ, SHI, and the XCI index.

Moderately overbought now: BBBY and VZ

Anything posted here may be off base.

Wednesday, June 21, 2006

Daily Update 6/21/06

YI: -2.5

To a buy: The XAU hourly at 10 AM yesterday.

Trying to bottom out here: AVP and RFMD

Standard oversold at this point: MSO and PETM

Moderately oversold: Heating Oil

Trying to hold some rising trend line support: C, IWM, and PPG

Trying to hold some falling trendline support: BKC, MMC, OXY, PDE, RHAT, and SUN

Attempting to break above the 28 DMA here: NI and PEG

To a hold for now: INTC

Trying to break above some falling trend line resistance: CHC, MO, PBY, PTR, and the XAU index.

Attempting to break above the 28 DMA here: AAUK, ERICY, and SYMC

Moderately overbought at this point: INTU and PG

Standard overbought here: BGF

To a sell: The XAU hourly at 1 PM yesterday.

Anything posted here may be off base.

Tuesday, June 20, 2006

Daily Update 6/20/06

YI: -2.5

Possible bottom here for: WON

Attempting to bottom out around this area is: DELL

Trying to hold some falling trendline support: GT

Trying to break above some falling trend line resistance: AMN, ASA, gold, HMC, KMX, and NXL

Attempting to break above the 28 day moving average: CAT, SPIR, and TKR

Moderately overbought at this point: HPQ and MRVL

A possible top may be forming in this area for: ENER, GYMB, and OGE

To a sell: The XAU hourly at 10 AM yesterday.

A break out in either direction is on the way for: FDP

Anything posted here may be off base.

Monday, June 19, 2006

Daily Update 6/19/06

The YI is now: -1.5

AVP is moderately oversold at this point, and the VXO is trying to hold the 28 day moving average here.

Trying to break above some falling trend line resistance at this point are: ACAS, AHO, BKS, CHINA, CHK, the DJ-30, ECA, ENER, ERICY, FCX, GFI, GOOG, HIT, HPQ, IIT, INTU, JNPR, MCD, SIFY, SKS, SLE, SLV, SMH, the S&P-500, TSS, TTH, and X

Attempting to break above the 28 day moving average here: CMI, CSCO, DJ, ELN, EOG, GR, KMX, LSS, MSCC, NWL, PPG, QQQQ, SEE, and WOR

Moderately overbought now: BA and JCP

Anything posted here has at least a slight chance of being totally off base.

Friday, June 16, 2006

Daily Update 6/16/06

YI: -1.5

Possible bottom here for: GT and LSI

Trying to bottom out around this level: APPB, BPOP, MFE, NXL, PDE, RMBS, SHI, SUN, WB, and XRX

Standard oversold at this point: SPC and WHR

Moderately oversold: NLY and RHAT

Trying to break above some falling trend line resistance at this point: AAPL, AMZN, BMY, CAT, EBAY, EMC, ERF, EWA, GNSS, IBM, the IIX index, LMT, MDC, MG135 and 136, MRVL, N, NFI, NG, NWL, PCU, PG, PHI, PLL, PMCS, QQQQ, RDC, RI, SCHW, SWC, TIE, TMO, the XCI index, XLK, and YCC

Attempting to break above the 28 DMA here: INTC

Now up against some rising trend line resistance is: BGF

Anything posted here may be off base.

Thursday, June 15, 2006

Daily Update 6/15/06

YI: -3

To a buy: The XAU hourly.

Possible bottom here: AMTD, CAT, the DJ-30, DO, EMC, JDSU, JOSB, PTR, and the XCI index.

Trying to bottom out in this area: AMN, BAA, BBBY, CDE, EWG, GLW, GRZ, HMY, the IIX index, JWN, KGC, MFLX, MMC, NEM, NFI, the OEX index, PLL, PMCS, QQQQ, REDF, RGLD, RI, SFY, SNE, STMP, SWC, TSS, USU, VIGN, XLF, XLK, and the XNG index.

Extremely oversold: The E-Mini 500, MDC, SLV, and the VXO

Standard oversold at this point: ALEX, ELY, ENER, gold, GPC, IYM, MER, MG136, PBY, PHG, RDC, RFMD, RIG, SCHW, SMH, SMTC, SU, THQI, TIE, WDC, WGII, WTS, and XLE

Moderately oversold: ACF, ARM, BAC, BHI, BKC, the BKX index, BPOP, the BTK index, CHINA, ELN, EWI, LYO, MO, MOT, MU, N, PETM, SKS, SLE, SNA, and TMO

Trying to hold some rising trend line support: AVP, DVY, ERF, IDA, and the S&P-500

Trying to hold some falling trend line support: AAUK, AIG, BKS, CAKE, CBK, CSCO, CY, F, IRF, MCD, OCR, SIFY, WMB, and the YI

Attempting to hold the 28 DMA here: CBK, CGI, and TXU

Trying to break above some falling trend line resistance: AA, ABX, AMAT, AMD, CHK, CREE, CSTR, DJ, the dollar, the DRG index, EWJ, EWP, EWQ, EWU, GLG, LSS, QCOM, RIO, SEE, SNDK, SPIR, SUN, the XAU index, XLB, and the XOI index.

Anything posted here may be off base.

Wednesday, June 14, 2006

Daily Update 6/14/06

YI: -3.5, so the market is starting to become significantly oversold.

To a buy: INTC

Possible bottom here: IFN and KEA

Trying to bottom out in this area: CMI, EBAY, GLG, JOSB, RADN, and XMSR

Extremely oversold now: JDSU

Standard oversold at this point: DO, EMC, EOG, ERICY, NSC, QCOM, TRF, and the XAU index.

Moderately oversold: FXE

Trying to hold some rising trend line support: AHO, CGI, CLG, CUP, ECA, EWD, FBR, GG, NG, NOK, TTH, TZOO, and X

Trying to hold some falling trend line support here: AA, AAPL, CHC, IIT, PCU, and WOR

Attempting to hold the 28 DMA here: BMY and MDT

To a hold for now: AMTD

Trying to break above some falling trend line resistance: PEG and SVU

Now up against some rising trend line resistance: OGE

Anything posted here may be off base.

Tuesday, June 13, 2006

Daily Update 6/13/06

YI: -2.5

Trying to bottom out: SYMC

Standard oversold: GRZ

Moderately oversold: INTU

Trying to hold some rising trend line support: C, the dollar, IWM, and TKR

Trying to hold horizontal trend line support: PDE

Trying to hold some falling trend line support: BBBY, MFE, and RMBS

To a hold for now: PLT

Trying to break above some falling trend line resistance: AAUK and MER

Now up against some rising trend line resistance: XLU

Stadard overbought: ENR

Anything posted here may be off base.

Monday, June 12, 2006

Here is the rest of today's TA analysis:

Trying to bottom out around this level are: TASR and XLB

Standard oversold: SNE and SWC

Now attempting to hold some rising trend line support: TMO and VZ

Trying to break above some rising trend line support: XLP

Anything posted here may be off base.

Daily Update 6/12/06

YI: -1.5

To a buy: AMTD

Possible bottom here for: AMD

Trying to bottom out in this area: AAUK, ASA, AU, GR, HIT, HMC, JDSU, NWL, PHI, and the YI

Extremely oversold at this point: INTC and JOSB

Standard oversold: BAA, GT, and PTR

Moderately oversold: EBAY, EWD, EWP, EWU, and GRZ

Trying to hold some rising trend line support: CHINA and GE

Trying to hold some falling trend line support: DJ, ENER, ERICY, the IIX index, and MMC

To no position for now: The dollar.

Trying to break above some falling trend line resistance: AMZN, the BKX index, IDA, IFN, MRVL, NSM, NXL, and QLGC

Attempting to break above the 28 DMA here: BPOP, MCD, PG, and SBUX

Moderately overbought: The dollar and NVLS

Standard overbought: RNR

To a sell: The XAU hourly at 11 AM on Friday.

I did not finish charting all of Friday's closing prices yet, so there may be some more signals or opinions by 1 PM.

Anything posted here may be off base.

Friday, June 9, 2006

Daily Update 6/9/06

YI: -1

To a buy: The XAU index at 1 PM yesterday.

Possible bottom here for: GG and NSM

Trying to bottom out in this area is: BMS, CAT, COP, the DJ-30, DO, the E-Mini 500, FCX, GFI, GPC, IFN, IYM, LSI, LSS, MG135, NOK, PCU, PNRA, PTR, RDC, RIO, the S&P-500, SPIR, STP, STX, SU, WGII, WHR, WTS, WY, the XAU index, and the XCI index.

Standard oversold at this point: AMN, EWJ, GLW, RGLD, TSM and the VXO

Moderately oversold: CMI, EWC, EWQ, GLG, PDE, RI, and X

Trying to hold some rising trend line support: ABX, BGF, heating oil, LYO, MU, NEM, OXY, RHAT, TXU, WDC, XLE, the XNG index, and the XOI index.

Trying to hold some falling trend line support at this point: ALEX, EOG, F, FTO, MG136, MTU, NTES, the OEX index, QQQQ, REDF, RFMD, RIG, SHI, SMH, SUN, THQI and WOR

Attempting to hold the 28 DMA here: BHI, CLG, CUP, ERF, GYMB, and SNA

Trying to break above some falling trend line resistance at this point: AAPL, CAKE, and LMT

Moderately overbought now: CGI

Anything posted here may be off base.

Thursday, June 8, 2006

Daily Update 6/8/06

YI: -1

Trying to bottom out: KEA, KMX, NG, OCR, and PHG

Standard oversold: ASA, AU, GFI, IFN, and IIT

Moderately oversold now: AAUK, EWG, GR, HPQ, NOK, PLL, and YHOO

Trying to hold some rising trend line support: AMAT, CHK, CLG, CMI, ELN, EWA, GLG, HMY, NFI, PHI, and SNA

Trying to hold some falling trend line support: CLF, EMC, LSS, MSCC, PBY, RADN, RIO, and SNE

Attempting to hold the 28 DMA here: FBR, INTU, and N

Trying to break above some falling trend line resistance: ACF, APPB, and DJ

Attempting to break above the 28 DMA here: The dollar and JWN

Moderately overbought now: JCP

A possible top may be forming in this area for: JNJ

A break out in either direction is on the way for: FDP

Anything posted here may be off base.

Wednesday, June 7, 2006

Daily Update Part 2

Moderately oversold: TKR, USU, and WTS

Trying to hold horizontal trend line support: SMH and XLP

Trying to hold some rising trend line support here: SCHW, SEE, SGP, the S&P-500, WOR, the XAU index, XLB, and XLU

Attempting to hold on to some falling trend line support: PMCS, QLGC, SLV, SPIR, STP, SYMC, TSM, and the XCI index.

Attempting to hold the 28 DMA here: SLE and VIGN

Anything posted here may be off base.

Daily Update Part 1

YI: 0

Standard oversold: AMD

Moderately oversold: DJ-30 and IRF

Trying to hold some rising trend line support: AA, AAUK, BAC, the BKX index, EWP, EWQ, EWU, F, FCX, FDP, GNSS, the IIX index, IYM, MG135, and OGE

Attempting to hold on to falling trend line support: AMN, AMTD, BA, BKS, CSTR, MDC, and PG

Attempting to hold the 28 DMA here: ECA, GM, KO, and MU

To no position: The XAU hourly at 1 PM yesterday.

Trying to break above some falling trend line resistance: ELY

Attempting to break above the 28 DMA: HMY

Moderately overbought now: heating oil

A break out in either direction is on the way for: CHINA and MCRS

Anything posted here may be off base.

Tuesday, June 6, 2006

Daily Update 6/6/06

"Mark of the Beast Day"

YI: 0

Trying to hold some rising trend line support in this area is: ALEX, the E-Mini 500, GM, GR, GRZ, NWL, "the QQQQ beast", and SMTC

Now trying to hold some falling trend line support: DJ, ELY, and IBM

To a hold for now: PMCS

Trying to break above some falling trend line resistance now is: AHO, EWA, WMB, and XLU

Attempting to break above the 28 DMA here: MOT, NEM, NXL, SNE, and WB

Moderately overbought: C, NI, PEG, and STMP

Standard overbought at this level: CUP, ERF, and OGE

Extremely overbought now is: CPB

A possible top may be forming in this area for: CBK

To a sell: The XAU hourly at 11 AM yesterday.

Anything posted here may be completely off base.

Sunday, June 4, 2006

Daily Update for: 6/5/06

YI: +1.5

A possible bottom may be forming in this area for: INTC

Trying to bottom out is: SNDK

Moderately oversold at this point: gold

Attempting to hold the 28 DMA here: The VXO and YHOO

Attempting to hold the 50 DMA: gold

To no position for now: MDC

Trying to break above some falling trend line resistance: ADP, BMY, CHINA, DUK, the E-Mini 500, GNSS, MSCC, RI, RMBS, SYMC, TRF, TTH, WON, and the XAU hourly.

Trying to break above horizontal trend line resistance: CGI

Attempting to break above the 28 DMA here: AA, AMAT, BBBY, BPOP, CHC, the DJ-30, EMC, EOG, EWG, GLW, GOOG, GR, the IIX index, IWM, IYM, JNPR, MDC, MER, MSO, NFI, NVLS, PBY, RGAT, SCHW, the S&P-500, SPC, TASR, TKR, VZ, WOR, XLB, and XRX

Moderately overbought now: ARM, CMI, DELL, DVY, ECA, FBR, INTU, MDT, Q, and RNR

Standard overbought at this point is: CBK

A possible top may be forming in this area for: ENR

A break out in either direction is on the way for: AVP

Anything posted here may be off base.

Friday, June 2, 2006

Daily Update 6/2/06

YI: +1

Possible bottom forming in this area for: BKS, ELY, and RADN

Trying to bottom out now is: AAPL

Standard oversold at this point: APPB

Moderately oversold: MFE

Trying to hold some rising trend line support here: BAA, EWG, GG, and MG136

Attempting to hold some falling trend line support: ASA, AU, and SLV

Attempting to hold the 28 DMA here: FXE

Trying to break above some falling trend line support at this juncture: AVP, BA, the BTK index, CHC, ENR, INTU, JWN, MER, MMC, MU, NI, PNRA, POM, PPG, SBUX, VZ, WY, and YCC

Attempting to break above the 28 DMA at this point: CHK, DO, EWP, JDSU, MCRS, PDE, and THQI

Now up against some rising trend line resistance: ERF

Standard overbought now is: BKC

A break out in either direction is on the way for: LYO and TMO

Anything posted here may be off base.

Thursday, June 1, 2006

Daily Update 6/1/06

YI: 0

A possible bottom may be forming in this area for: SBUX and TSM

Trying to bottom out now are: MRVL, NSM, and VIGN

Standard oversold at this point is: BKS

Moderately oversold now: BA, MRK, and SNDK

Trying to hold some rising trend line support at this juncture: ABX, AMTD, the BKX index, CPB, EWA, GOOG, the IIX index, KO, RGLD, RI, SGP, SNE, SPC, SPIR, STMP, STP, TTH, VZ, and WTS

Attempting to hold horizontal trend line support: The DJ-30

Trying to hold some falling trend line support: GT and MFE

Attempting to hold the 28 DMA here is: RNR

To no position: The XAU hourly at 11 AM yesterday.

Now trying to break above some falling trend line resistance: GLW, MCD, MCRS, MTU, RADN, THQI, and XMSR

Attempting to break above horizontal trend line resistance is: CLG

Attempting to break above the 28 DMA here: The BTK index, EWQ, KGC, and SMTC

Moderately overbought now is: WMB

A possible top may be forming in this area for: ELN

Anything posted here may be off base.